Sterling Weekly for the Week of January 28th, 2013

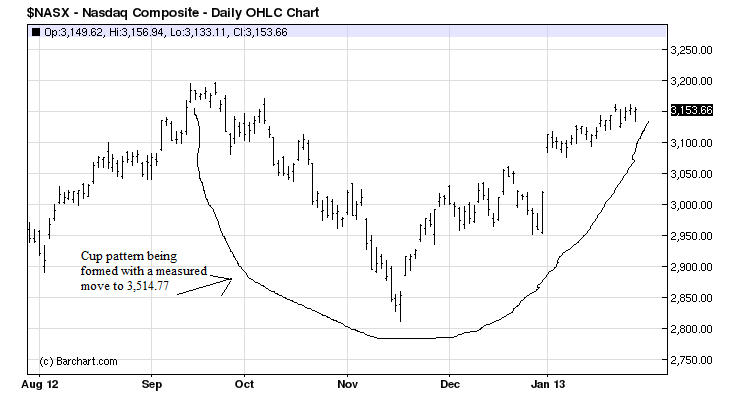

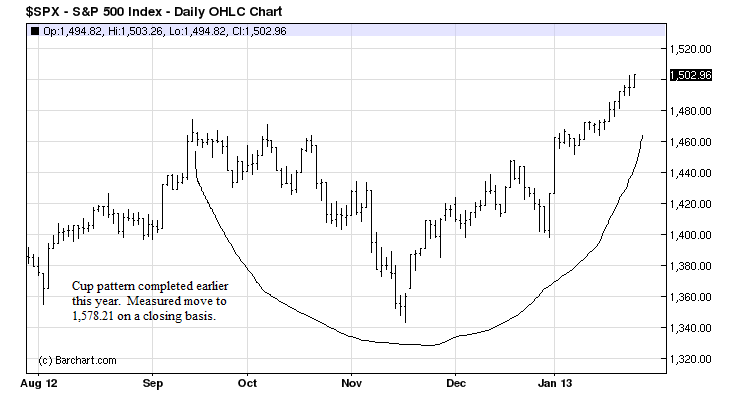

Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average rose 647.54 points or approximately 4.9% to 13,895.98. As I stated last week in the January 17th edition of Sterling Market Commentary, I feel that the Dow Jones Industrial Average has completed a cup pattern with a measured move to 14,677.92 on a closing, and that it would probably take a couple of months to get there.

In this week’s edition of the Sterling Weekly, I decided to publish our annual performance report on the various sector indices that we track. I always tend to find this interesting as I feel that it tells us a fair amount about the stat of the U.S. economy. For the year, the Dow Jones Industrial Average was higher by $886.58 points or approximately 7.26%, and the NASDAQ 100 ‘NDX’ was higher by 383.10 points or approximately 16.82% primarily driven by the strength of Apple, Inc. ‘APPL’; while the S&P 500 was higher by 168.59 points or approximately 13.41%. The average index was higher by approximately 10.3%

I think we should consider 2012 as the year of restructuring. My thoughts are that while the Amex Biotech Index ‘BTK’ is always one of the top performing indices, the remainder of the top performing indices benefited from restructuring activity; Airlines, Banking, Chemicals, Healthcare, and Cyclicals. Unlike previous years, I do not see a clear message in the ranking of the remaining indices. I think this is a reflection of the uncertainty in the U.S. economy resulting from the election and all the new regulatory changes scheduled to take effect this year.

| Sterling Investment’s 2012 Market Index Performance Report |

|

|

|

|

|

|

|

Ticker |

Closing Level |

1 Year Change |

| Index Name |

Symbol |

31-Dec-12 |

31-Dec-11 |

Points |

Percent |

| Amex Biotech Index |

BTK |

1,547.03 |

1,091.42 |

455.61 |

41.74% |

| Amex Airlines Index |

XAL |

44.25 |

32.44 |

11.81 |

36.41% |

| KBW Banking Index |

BKX |

51.28 |

39.38 |

11.90 |

30.22% |

| MS. Healthcare Providers |

RXP |

2,107.96 |

1,733.89 |

374.07 |

21.57% |

| S&P Chemicals Index |

CEX |

361.03 |

298.73 |

62.30 |

20.85% |

| MS Cyclical Index |

CYC |

1,047.05 |

874.14 |

172.91 |

19.78% |

| North Am. Telecom Index |

XTC |

1,047.18 |

881.99 |

165.19 |

18.73% |

| NASDAQ 100 Index |

NDX |

2,660.93 |

2,277.83 |

383.10 |

16.82% |

| MS. High Tech. Index |

MSH |

685.80 |

588.88 |

96.92 |

16.46% |

| Amex Interactive |

IIX |

327.00 |

281.74 |

45.26 |

16.06% |

| CBOE Technology Index |

TXX |

986.12 |

851.59 |

134.53 |

15.80% |

| Russell 1000 Index |

RUI |

789.90 |

693.36 |

96.54 |

13.92% |

| S&P 500 Index |

SPX |

1,426.19 |

1,257.60 |

168.59 |

13.41% |

| Amex Sec. Broker/Dealer |

XBD |

94.34 |

83.27 |

11.07 |

13.29% |

| S&P 100 Index |

OEX |

646.61 |

570.79 |

75.82 |

13.28% |

| Amex Pharmaceuticals |

DRG |

369.57 |

332.94 |

36.63 |

11.00% |

| Computer Tech. Index |

XCI |

1,075.49 |

973.96 |

101.53 |

10.42% |

| MS Consumer Index |

CMR |

837.14 |

759.13 |

78.01 |

10.28% |

| Dow Jones Industrial Avg. |

DJ-30 |

13,104.14 |

12,217.56 |

886.58 |

7.26% |

| Dow Jones Transportation |

DJ-20 |

5,306.77 |

5,019.69 |

287.08 |

5.72% |

| Phlx. Semiconductor Index |

SOX |

384.06 |

364.44 |

19.62 |

5.38% |

| Amex Networking |

NWX |

226.55 |

215.15 |

11.40 |

5.30% |

| Natural Gas Index |

XNG |

650.11 |

636.15 |

13.96 |

2.19% |

| Phlx. Oil Services Sector |

OSX |

220.16 |

216.28 |

3.88 |

1.79% |

| Amex Oil & Gas |

XOI |

1,241.84 |

1,229.10 |

12.74 |

1.04% |

| Amex MS Commodities |

CRX |

840.61 |

844.94 |

(4.33) |

-0.51% |

| Amex Disk Drive |

DDX |

99.45 |

101.79 |

(2.34) |

-2.30% |

| Dow Jones Utilities Index |

DJ-15 |

453.09 |

464.68 |

(11.59) |

-2.49% |

| Phlx. Utility Sector |

UTY |

458.63 |

481.45 |

(22.82) |

-4.74% |

| Phlx. Gold/Silver Index |

XAU |

165.60 |

180.64 |

(15.04) |

-8.33% |

| Amex Gold Miners |

GDM |

1,288.22 |

1,428.98 |

(140.76) |

-9.85% |

| Amex Gold Bugs |

HUI |

444.22 |

498.73 |

(54.51) |

-10.93% |

|

|

|

———- |

———- |

———- |

| Average |

|

|

1,172.58 |

108.30 |

10.30% |

Sterling Market Commentary Blog

As part of our new services we are now publishing a blog. The primary focus of our blog is a daily market commentary.

Small Cap Research

Sterling Investment Services publishes custom research on micro and small cap companies. Our focus is on companies that are not receiving research coverage from the brokerage community.

Our latest research report profiles OxySure Systems, Inc. (OTC: ‘OXYS’). This company is a medical technology company that produces specialty medical and respiratory systems. We feel the company is an interesting growth story. To see a copy of our report, please click here.

We continue to maintain coverage on Probe Manufacturing, Inc. (OTC: ‘PFMI’) This company is a contract electronics that we feel is an interesting turn around story. To see a of our report, please here.

Companies that are interested in obtaining research coverage should click here.

Disclaimer: The Sterling Investments series of newsletters is produced by Sterling Investment Services, Inc. All information used in the production has been obtained from sources believed to be reliable and accurate. Sterling Investment Services does not warrant or assume any liability for inaccuracy of the information used to produce our publications. To receive further information on these services please visit our web page at: www.sterlinginvestments.com If you would like to contact us our fax # is (404)-816-8830 Email address is: enelson@sterlinginvestments.com Sterling Investment Services may hold positions in the securities recommended or may be providing consulting services to the companies mentioned within this report.