Sterling Market Commentary for Wednesday January 30th, 2013

A Look at Tuesday’s Market: The overall market moved moderately higher in yet another broad based move that saw the majority of the various indices I track move higher as well. In the commodities markets, Oil was higher by $1.13 to $97.57 per barrel, and Gold was higher by $7.90 to $1,660.80 per ounce. In the grain markets, Wheat was lower by $0.022 to $7.770 per bushel, and Corn was higher by $0.002 to $7.294 per bushel, while Soybeans were to $0.040 to $14.516 per bushel.

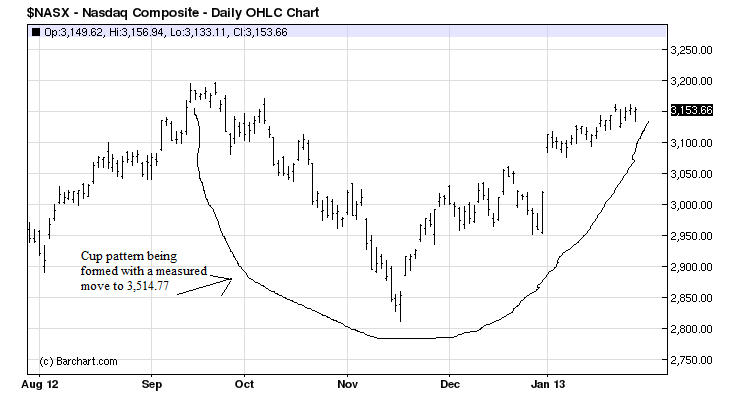

A Few Thoughts on Wednesday’s Market: With yesterday’s move higher by the overall market, the Dow Jones Industrial Average and the S&P 500 both set new short term closing highs. I thought today would be a good opportunity to take a look at the NASDAQ Composite Index which closed yesterday at 3,117.50 but has yet to set a new short term closing high. I have inserted a chart of the NASDAQ Composite below for your review.

The NASDAQ Composite Index set a short term closing high when it closed at 3,183.95 on Friday September 14th of last year. From there, the NASDAQ Composite declined to a low of 2,853.13 before rallying back to its current levels. It looks like the NASDAQ Composite may be in the process of completing a cup pattern. While the cup pattern will not be completed until the NASDAQ Composite closes above 3,183.95 However, if the NASDAQ Composite closes above 3,183.95 in the near term, then it will have completed a cup pattern with a measure move to 3,514.77 on a closing basis. Be warned that once the NASDAQ Composite completes the cup pattern, it does not forecast a move directly or quickly to the 3,514.77 level, or that there will not be pullbacks along the way. But I do think it provides a reasonable target for the NASDAQ Composite 6 to 9 months out.

The Bottom Line: I am continuing to expect the overall market to move sideways with an upward bias.

Follow us on Twitter under sterlinginv and get our intra-day comments on the market.