Sterling Market Commentary for Monday January 28th, 2013

A Look at Friday’s Market: The overall market moved moderately higher on Friday in a relatively broad based move that saw the majority of the various sector indices I track move higher as well. In the commodities markets, Oil was lower by $0.07 to $95.88 per barrel, and Gold was lower by $13.30 to $1.656.60 per ounce. In the grain markets, Wheat was higher by $0.080 to $7.764 per bushel, and Corn was lower by $0.034 to $7.206 per bushel, while Soybeans were higher by $0.056 to $14.410 per bushel.

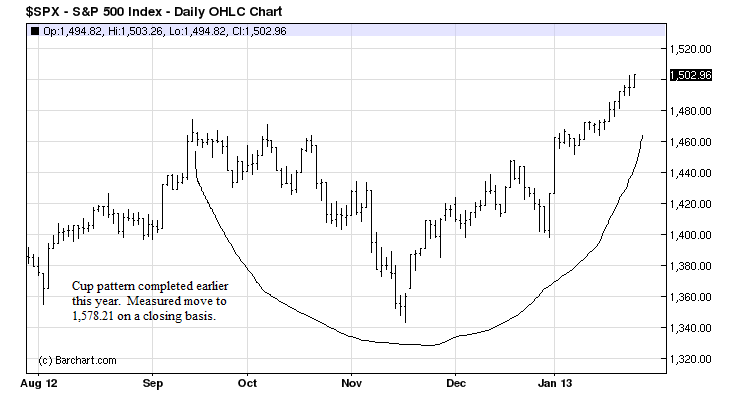

The S&p 500 closed above 1,500 for the 1st time since late 2007. While this is not an all-time high, I thought it was important to take a look at the current chart of the S&P 500 and see what it tells us. I’ve have inserted the chart below for your review.

It looks like in the first week of 2013, the S&P 500 completed a cup pattern, which I have drawn on the chart. As frequent readers of my blog and newsletters will know, I believe that cup patterns are among the most reliable chart patterns. The starting point on the cup pattern was 1,465.77 the S&P 500’s closing level on Friday September 14th of last year; and the low point was 1,353.33 the S&P 500’s close on November 15th. This puts our near term upside target on the S&P 500 at 1,575.21 on a closing basis.

A Few Thoughts on Monday’s Market: I think the overall trend of the market is to the upside. I continue to remain cautious due to the situation in Washington D.C., however I think the gridlock in Washington provides a form of stability that allows businesses show some form of stability, at least in the short term.

The Bottom Line: I am expecting the overall market to continue to move higher.

Follow us on Twitter under sterlinginv and get our intra-day comments on the market.