Sterling Market Commentary for Wednesday November 7th, 2012

A Look at Tuesday’s Market: The overall market moved sharply higher Tuesday in a very broad based move that saw virtually every sector index I track move higher with the exception of the Utilities. During the day, the financial news outlets were attributing the move higher as a sign that Barack Obama was going to be re-elected as President of the United States. I think the utilities are under pressure for several reasons, the 1st being the damage that was sustained in the northeast from Hurricane Sandy and the political fallout that could occur in New York as Governor Cuomo has made statements about the utilities loosing their monopoly status. The 2nd reason being that if Mitt Romney would have won the election, then Ben Bernanke would have been most likely out of a job and that would have almost certainly guaranteed a rise in interest rates. Rising interest rates are normally bad for utility stocks which have a large portion of their valuation based upon dividend yield. The 3rd item I see weighing on the Utilities is that the re-election of Barrack Obama will give the Environmental Protection Agency (EPA) the green light to implement all the new regulations that they were holding off on until after the elections. Basically it looks like the utilities were in a loose – loose situation this election year.

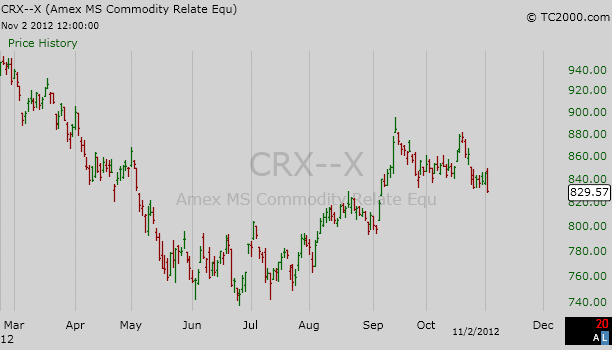

In the commodities markets, Oil was higher by $3.06 to $88.71 per barrel, and Gold was higher by $31.80 to $1,715.00 per ounce. In the grain markets, Wheat was higher by $0.110 to $8.770 per bushel, and Corn was higher by $0.054 to $7.410 per bushel, while Soybeans were higher by $0.122 to $15.154 per bushel. Loose money and a weak dollar almost always leads to more inflation; and those two policies are a hallmark of the Obama administration. I think the commodities markets were reacting to the prospects of Obama winning re-election yesterday.

A Few Thoughts on Wednesday’s Market: I think it is too early to say that the direction of yesterday’s market is a new trend. In looking a the charts from yesterday’s trading activity, I think there is a good chance that the market may be starting to put in a bottom or find some support. However, as I write this blog this morning, the pre-market futures are sharply lower. If we give up yesterday’s gains, and move lower over the course of the next several days, then I do not see any support being formed at these levels and I think we could look for a continued move towards our stated support targets. I personally think it will take a couple of days or even a few weeks to sort out the election results.

The Dow Jones Industrial Average: The Dow Jones Industrial Average closed at 13,245.68 I see upside resistance level on the Dow Jones Industrial Average at 13,275.20 on a closing basis. I now see downside support coming in at 13,000.71 and then at 12,943.82 on a closing basis. I should point out that the support level at the 12,943.82 level is basically a “double bottom” on the charts and breaking through this level would be significant. Current Expectations: I think we are starting a new trend lower in the Dow. I am expecting the Dow Jones Industrial Average to continue to move lower and test 13,000.71 and then 12,943.82 on a closing basis.

Dow Jones Transportation Average: The Dow Jones Transportation Average closed at 5,203.64 I see upside resistance on the the Dow Transportation Average at 5,215.97 and downside support at 4,873.76 and then at 4,795.28. Current Expectations: I think the Dow Transports are going to track sideways between support and resistance for the foreseeable future.

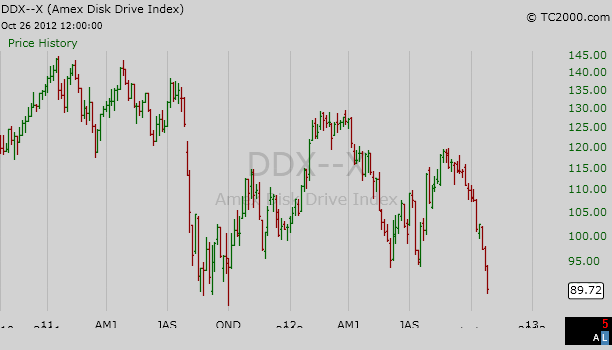

NASDAQ 100 Index ‘NDX’: The NDX closed yesterday at 2,681.05 I see upside resistance on the NDX currently at 2,687.52 and downside support at 2,647.47 and then at 2,623.33 on a closing basis. Current Expectations: I think the NDX is going to continue to move lower and test 2,647.47 and then 2,623.33 on a closing basis.

The Bottom Line: I think the market will continue to move lower for the next few trading sessions.