A Look at Friday’s Activity:

The overall market was sharply lower in a broad based move that saw every index I track move lower on the day. The weakest sectors were the High Tech, Natural Gas, Oil Services, Biotech, Banking, Cyclicals, Commodities, Oil & Gas, and Chemicals. The rest of the sector indices I track moved lower as well.

Oil was lower by $1.81 to $87.24 per barrel, and Gold was higher by $1.90 to $1,857.10 per ounce. Wheat was lower by $0.082 to $7.296 per bushel, Corn was higher by $0.024 to $7.364 per bushel, and soybeans were higher by $0.084 to $14.26 per bushel.

The markets are obviously under pressure due to the continuing sovereign debt problems in Europe. The fact that the Europeans are having these problems should come as no surprise to anyone. A big portion of the current phase of the European sovereign debt crisis is an unwillingness of voters on both sides of the table to go along with the bailout program. In our June Market Commentary Blog I warned our readers that this could potentially be a big problem.

I think there is a serious possibility that the voters in these debtor countries will be more than willing to drive their own bus off the cliff with the petal to metal, full speed ahead. I am not sure there is much that we, or anyone else outside of these countries can do to prevent this.

A Few Thoughts Before the Open:

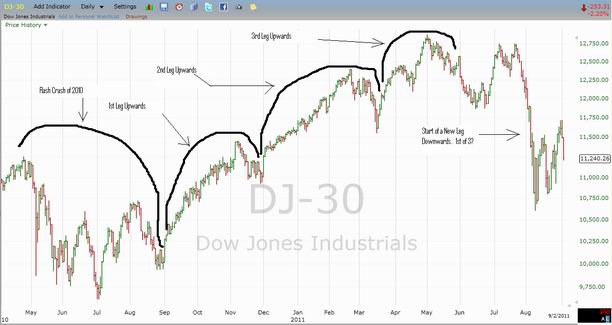

The pre-open futures are sharply lower for all the major market indices. It looks like we are in for another day to the downside here in the United States. I think today is a good time to take a look at the support levels on the various indices I have writing about recently. The Dow Jones Industrial Average is the most significant market index in the United States, it is the leader to which all other indices march. The Dow Jones Industrial Average closed Friday at 10,992.13 We are looking at an approximately 200 point drop in the Dow Jones Industrial Average on the open of the U.S. markets.

I have been stating for some time that I see downside support on the Dow Jones Industrial Average at 10,719.94 on a closing basis. The question of the day becomes if support is broken at 10,719.94 where is the next level of support?

I think we need to take a look at the trading levels following the “flash crash of 2010.” I see downside support at 10,605.50 and then at 10,450.64 If those levels fail, then I see the lower end of downside support at 9,686.48 I hate to say it, but with the current scenario concerning the world economy and our own political climate I think there is a realistic chance we will test support at 9,686.48 sometime this fall.

In looking at the various indices I track, I have the following comments.

Dow Jones Industrial Average: The Dow Jones Industrials closed at 10,992.13 The Dow sold off on Friday and closed below its 8-day moving average. I currently see upside resistance on the Dow at 11,493.57 and downside support at 10,719.94 on a closing basis. I am currently expecting the Dow to continue to move lower and test its downside support at 10,719.94 on a closing basis.

S&P 500 ‘SPX’: The S&P 500 closed at 1,154.23 I see upside resistance on the S&P 500 at 1,218.89 and downside support at 1,127.79 on a closing basis. I am currently expecting the S&P 500 to continue to move lower and test 1,127.97 on a closing basis.

NASDAQ 100 Index ‘NDX’: The NASDAQ 100 closed at 2,163.66 I continue to see downside support on the NDX at 2,100 and upside resistance at 2,292.34.

The Dow Jones Transportation Average: The Dow Transports closed at 4,368.99 I see upside resistance on the Dow Transports at 4,683.96 and downside support level at 4,320.05 on a closing basis. I am currently expecting the Dow Transports to continue to move lower and test 4,320.05 on a closing basis.

M.S. Commodities Related Equity Index ‘CRX’: The ‘CRX’ closed at 875.52. I see upside resistance on the ‘CRX’ at 924.89 and downside support at 847.10

KBW Banking Index ‘BKW: The ‘BKW’ closed at 36.23. I see upside resistance on the ‘BKW’ at 41.42 and downside support at approximately 35.10 on a closing basis.

S&P Banking Index ‘BIX’: The ‘BIX’ closed 110.56. I see upside resistance on the ‘BIX’ at 117.52 and downside support at 100.96 on a closing basis.

Amex Broker/Dealer Index ‘XBD’: The ‘XBD’ closed at 83.30 I see upside resistance at 92.97 and downside support at 80.87 on a closing basis. I am expecting the ‘XBD” to continue to move lower and test 80.87 on a closing basis.

S&P Insurance Index ‘IUX’: The ‘IUX’ closed at 153.02 I see upside resistance on the ‘IUX’ at 175.13 and downside support at 143.80 on a closing basis. I am currently expecting the ‘IUX’ to continue to move lower and test 143.80 on a closing basis.

Amex Gold & Silver Index: The Amex Gold & Silver Index ‘XAU’ closed at 223.21 I see upside resistance on the ‘XAU’ at 228.95 and downside support at 220.36 I am expecting the ‘XAU’ to continue to move higher and test 228.95 on a closing basis.

Amex Oil & Gas Index: The Amex Oil & Gas Index closed at 1,102.41 I currently see upside resistance on the ‘XOI’ at 1,141.92 on a closing basis and downside support at 1,050.78. I am expecting the ‘XOI’ to continue to move lower and test 1,050.78 on a closing basis.

M.S. Cyclicals Index: The M.S. Cyclicals Index ‘CYC’ closed yesterday at 822.19 I currently see upside resistance on the ‘CYC’ at 868.97 and downside support at 789.46 on a closing basis. I am currently expecting the ‘CYC’ to continue to move lower and test 789.46 on a closing basis.

M.S. Consumer Index: The M.S. Consumer Index ‘CMR’ closed at 716.51 I currently see upside resistance on the ‘CMR’ at 725.78. and downside support at 691.44 on a closing basis.