Sterling Market Commentary for Wednesday October 24th, 2012

A Look at Tuesday’s Market: The overall market moved sharply lower in a very broad based move that saw every index I track move lower on the day with the exception of the Transportation and Semiconductors. The weakest sectors on the day were the Chemicals, Gold/Silver, Oil & Gas, Commodities, Biotech, Oil Services, Banking, Industrials, Insurance, Healthcare related and the Consumer indices. In looking at the charts from Tuesday’s trading, one of the things that I noticed was that many of the various indices I track either hit their 40 day or 200 day moving averages. While it is tempting to say that they found support at those levels, I think it is more appropriate in today’s world of computerized trading that the computers are pretty much all programed by a bunch of programers who all read the same book on technical analysis and stopped selling once they got close to those levels and started to cover their shorts so they could be flat at the end of the day. However, negative news before the open and we could see the market easily blow through those levels.

In the commodities markets, Oil was lower by $1.98 to $86.67 per barrel, and Gold was lower by $16.90 to $1,709.40 per ounce. In the grain markets, Wheat was lower by $0.094 to $8.686 per bushel, and Corn was lower by $0.052 to $7.560 per bushel, while Soybeans were higher by $0.066 to $15.532 per bushel.

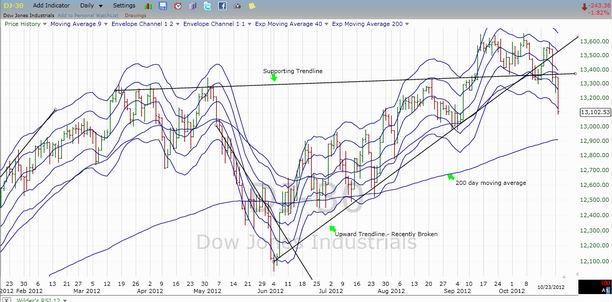

A Few Thoughts Wednesday’s Market: The Dow Jones Industrial Average closed yesterday at 13,102.53. In doing so, it clearly broke a supporting trendline that started in early March of this year. I have inserted a chart on the Dow Jones Industrial Average below for you to review. I think we are starting a new short to intermediate term downward trend. I believe that there is a very good possibility that we could see the Dow Jones Industrial Average continue to move lower and test its 200 day moving average at 12,908.33 on a closing basis. I should also point out that today is a rather quite day for economic news and unless there is a major earnings miss, then it is reasonable to expect a bounce in the market today. However, initial and continuing jobless claims are due to be released Thursday morning, and we could Thursday’s economic announcements could spark a move either way in the market. My guess is if we see a rise in initial jobless claims, then the market will probably head back lower.

The Dow Jones Industrial Average: The Dow Jones Industrial Average closed at 13,102.53 With the recent downturn in the Dow Jones Industrial Average I am now lowering my upside resistance level on the Dow Jones Industrial Average at 13,275.20 on a closing basis. I now see downside support coming in at 13,000.71 and then at 12,943.82 on a closing basis. I should point out that the support level at the 12,943.82 level is basically a “double bottom” on the charts and breaking through this level would be significant. Current Expectations: I think we are starting a new trend lower in the Dow. I am expecting the Dow Jones Industrial Average to continue to move lower and test 13,000.71 and then 12,943.82 on a closing basis.

Dow Jones Transportation Average: The Dow Jones Transportation Average closed at 5,087.63 I see upside resistance on the the Dow Transportation Average at 5,215.97 and downside support at 4,873.76 and then at 4,795.28. Current Expectations: I think the Dow Transports are going to track sideways between support and resistance for the foreseeable future.

The Bottom Line: I think the market will continue to move lower for the next few trading sessions.