Sterling Market Commentary for Thursday January 17th, 2013

A Look at Wednesday’s Market: The overall market finished Wednesday mixed with the major market indices mixed as well. The Dow Jones Industrial Average was slightly lower while the S&P 500 and Dow Jones Industrial Average were slightly higher. In the commodities markets, oil was higher b $94.68 per barrel, and Gold was lower by $0.70 to $1,683.20 per ounce. In the grain markets, Wheat was higher by $0.022 to $7.850 per bushel, and Corn was higher by $0.060 to $7.312 per bushel, while Soybeans were higher by $0.23 to $14.364 per bushel.

A Few Thoughts on Thursday’s Market: I have very grave concerns about the situation in Washington DC., and what I view as a very strong possibility that the negotiations over the raising of the debt ceiling for the Federal Government will not go well and will result in a very negative situation for the U.S. Economy and the U.S. stock market. However, I have to admit that the overall trend of the market is currently to the upside. In Tuesday’s edition of the Sterling Market Commentary I looked at the Dow Jones Transportation Average, and what I thought the measured move to higher levels would be if the Dow Transports completed a cup pattern that was being formed. In order to complete the cup pattern the Dow Jones Transportation Average needed to closed above 5,618. Well on the Dow Jones Transportation Average has closed above that level the last two (2) trading days.

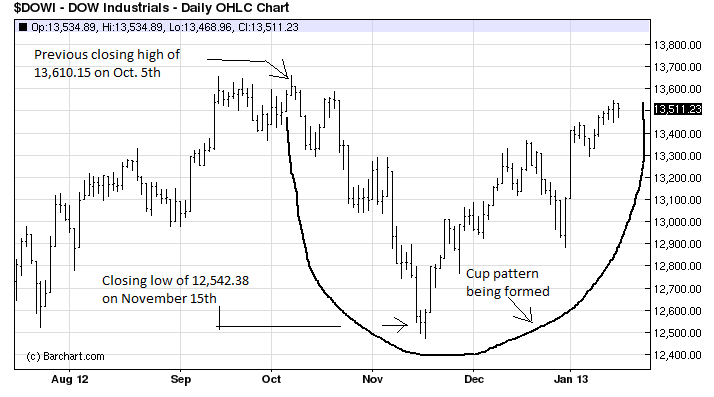

Since I am a believer in Dow Theory, which essentially states that any sustained move higher by the Dow Jones Industrial Average will be confirmed by a move higher in the Dow Jones Transportation Average, I thought now would be a good time to take a closer look at the Dow Jones Industrial Average. I have inserted a chart of the Dow Jones Industrial Average below for your review.

As you can see the Dow Jones set a closing high of 13,610.15 on October 5th of last year and then declined to a low of 12,542.38 on November 15th before rallying back to its current levels. Yesterday the Dow Jones Industrial Average closed at 13,511.23. If the Dow Jones Industrial Average can move an 100 points or so higher and close above 13,610.15 then it will have completed a cup pattern with a measured move to 14,677.92 It is always difficult to forecast the amount of time it would take for the Dow Jones Industrial Average to reach the 14,600 level. However, based upon my past experience, I would estimate that it would be somewhere between 9 and 15 months.

I should point out that until the Dow Jones Industrial Average closes above 13,610.15 the cup pattern is not completed, and there should not be any expectations for the Dow Jones Industrial Average reaching the 14,600 level. Additionally there is always the chance that the Dow Jones Industrial Average has entered an area of resistance that it cannot break through, and as a result the Dow Jones Industrial Average may turn back lower. All it would take for this to happen is some bad earnings announcements or more negative news out of Washington, Europe, or China.

The Bottom Line: I am expecting the overall market to continue to drift sideways with a slight upward bias.