Sterling Market Commentary for Tuesday January 15th, 2013

A Look at Monday’s Market: The overall market moved moderately higher in a relatively broad based move that saw the majority of the various sector indices I track move higher on the day as well. In the commodities markets, Oil was higher by $0.58 to $94.14 per barrel, and Gold was higher by $8.80 to $1,669.40 per ounce. In the grain markets, Wheat was higher by $0.122 to $7.670 per bushel, and Corn was higher by $0.152 to $7.240 per bushel, while Soybeans were higher by $0.446 to $14.180 per bushel.

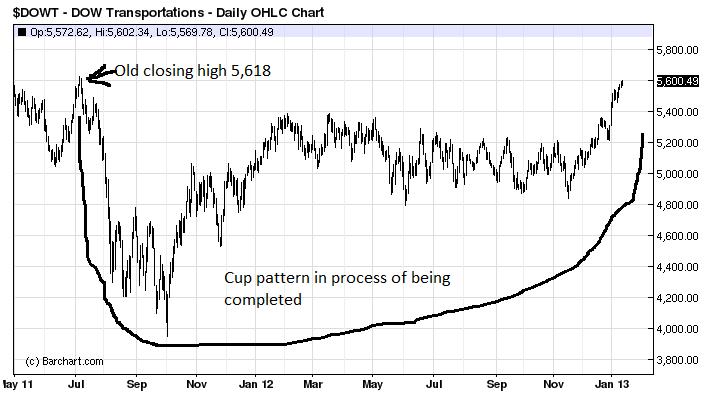

A Few Thoughts on Tuesday’s Market: In reviewing the charts from yesterday’s trading activity, the chart of the Dow Jones Transportation Average caught my eye. The Dow Jones Transportation Average closed yesterday at approximately 5,600. The Dow Jones Transportation Average has quietly set a new yearly high over the course of the last couple of weeks. It now appears to be within a few points of completing a longer term cup pattern, which upon completion would signal a move significantly higher by the Dow Jones Transportation Average. I have included a chart of the Dow Transports below for your review.

The Dow Jones Transportation Average set a closing high of approximately 5,618.25 back on July 7th of 2011, and reached a closing low of 4,038.73 on October 3rd of 2011. If the Dow Jones Transportation Average closes above 5,618.25 it will have completed a cup pattern with a long term measured move to approximately 7,197.77 While I am not predicting this to be a fast move, the strength in the Dow Jones Transportation Average is significant if you believe in the Dow Theory, which basically states that any sustained move higher by the Dow Jones Industrial Average will need to be confirmed by the Dow Jones Transportation Average.

My thoughts are that the current move higher by the Dow Jones Industrial Average is being confirmed by the Dow Jones Transportation Average, and as a result we may see the overall market push new highs at some point this year. However, I continue to see a great deal of political risk to the market. I think there is a very good chance that the negotiations to raise the Federal debt ceiling are going to turn into a bare knuckled fight that is guaranteed to leave at least one side bloodied. If this happens, any thoughts of the market setting significant new highs in the near future may be off the table for quite some period of time.

The Bottom Line: I am expecting the overall market to track sideways with a slight upwards bias over the course of the next several trading sessions.