Sterling Weekly for the Week of December 12th, 2012

A Look at the Possibility of Year End Tax Planning to Explain Recent Market Moves

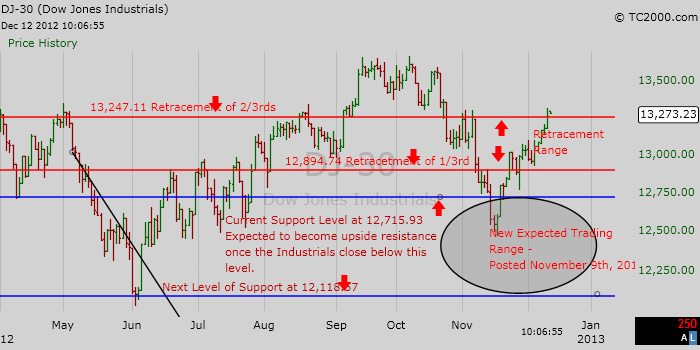

Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average declined 188.69 points or approximately 1.4% to Tuesday December 11th’s closing level of 13,248.44. Since then the move has been anything but a straight line. On October 5th, the Dow Jones Industrial Average reached a closing high of 13,610.15 and then declined to a low of 12,542.38 before rallying back to its current levels. In the Sterling Market Commentary for Friday November 23rd I discussed my thoughts on a possible retracement back to higher levels of the recent market sell off before it would be resume its downward path. However, yesterday’s closing level of 13,248.44 was within 2 points of the upper end of my expected retracement range of 13,247.11 So unless the market suddenly turns back lower, I think there is a good chance that we will see the market test its October highs. In looking at the market and attempting to determine where it goes from here, it is important to try to understand what has happened since early October. I have inserted a chart on the Dow Jones Industrial Average below for your review.

In looking at the market activity since October 5th, I start wonder if what we are looking at is a the effects of a trading strategy designed to avoid the “wash sale” tax rules, and to lock in capital gains at the lower tax rate prior to the Fiscal Cliff on December 31st, 2012? It is an interesting question. A “wash sale” is the sale of a security (stock, bond or options) at a loss and repurchasing the same or substantially identical stock shortly before or after. The idea is to make an unrealized loss claimable as a tax deduction, by offsetting against other capital gains or future tax years. The stock is then repurchased in hopes of it recovering in value. The United States disallows wash sales for tax deductions if the wash sale occurs within a 30 day time period. However, if there is more than 30 days between the time of the sale, and the date of the repurchase, then the deduction of the loss for tax purposes is allowed.

So this is how it see this having worked in the current situation. Investors and traders begin selling stocks 30 days before the November 6th election. This way if President Obama wins they can buy back in and square up their portfolios before the end of the year; and in the process they will have locked in the losses and the lower tax rate on their capital gains. The advantage is that you get to reset your cost basis on your gains and reduce your tax bill in the process. At the same time the losses reduce the amount of the final check sent to the Internal Revenue Service (IRS). If Mitt Romney would have won the election there was still no guarantee he could avoid all the tax increases of the Fiscal Cliff or those scheduled to take place due to Obamacare. Waiting until after the election to implement this trading strategy would not have made sense as it would have left very little time to square up the portfolios.

If I am correct, and this is what did occur, then I expect the market to continue to move higher and test the highs set in early October. My estimate is that this situation will clarify itself within the next few trading days.

Sterling Calendars for the Week of December 10th, 2012 |

|||||

Date |

Est. Time |

Releases |

For |

Consensus |

Prior |

| 12/11 | 8:30am | Trade Balance | Oct. | ($42.8B) | ($40.3B) |

| 12/11 | 10:00am | Wholesale Inventories | Oct. | 0.4% | 1.1% |

| 12/12 | 7:00am | MBA Mortgage Index | 12/08 | N/A | 4.5% |

| 12/12 | 8:30am | Export Prices – Ex Ag. | Nov. | N/A | 0.2% |

| 12/12 | 8:30am | Import Prices – Ex Oil | Nov. | N/A | 0.3% |

| 12/12 | 10:30am | Crude Inventories | 12/08 | N/A | (2.357M) |

| 12/12 | 12:30pm | FOMC Rate Decision | Dec. | 0.25% | 0.25% |

| 12/12 | 2:00pm | Treasury Budget | Nov. | ($113.0B) | ($137.3B) |

| 12/13 | 8:30am | Initial Claims | 12/08 | 375K | 370K |

| 12/13 | 8:30am | Continuing Claims | 12/01 | 3,200K | 3,205K |

| 12/13 | 8:30am | Retail Sales | Nov. | 0.4% | (0.3%) |

| 12/13 | 8:30am | Retail Sales Ex-Auto | Nov. | 0.0% | 0.0% |

| 12/13 | 8:30am | Producer Price Index ‘PPI’ | Nov. | (0.5%) | (0.2%) |

| 12/13 | 8:30am | Core Producer Price Index ‘PPI’ | Nov. | 0.1% | (0.2%) |

| 12/13 | 10:00am | Business Inventories | Oct. | 0.4% | 0.7% |

| 12/14 | 8:30am | Consumer Price Index ‘CPI’ | Nov. | 0.2% | 0.1% |

| 12/14 | 8:30am | Core Consumer Price Index ‘CPI’ | Nov. | 0.1% | 0.2% |

| 12/14 | 9:15am | Industrial Production | Nov. | 0.3% | (0.4%) |

| 12/14 | 9:15am | Capacity Utilization | Nov. | 78.0% | 77.8% |

Sterling Market Commentary Blog

As part of our new services we are now publishing a blog. The primary focus of our blog is a daily market commentary.

Small Cap Research

Sterling Investment Services publishes custom research on micro and small cap companies. Our focus is on companies that are not receiving research coverage from the brokerage community.

Our latest research report profiles OxySure Systems, Inc. (OTC: ‘OXYS’). This company is a medical technology company that produces specialty medical and respiratory systems. We feel the company is an interesting growth story. To see a copy of our report, please click here.

We continue to maintain coverage on Probe Manufacturing, Inc. (OTC: ‘PFMI’) This company is a contract electronics that we feel is an interesting turn around story. To see a of our report, please here.

Companies that are interested in obtaining research coverage should click here.