Since the previous edition of the Sterling Weekly the Dow Jones Industrial Average declined 397.19 points or approximately 3.4% to 11,240.26 With all the recent market volatility I thought now would be a good time to take a good look at the Dow Jones Industrial Average and where I think it is headed. As even a casual reader of this newsletter will recall, I consider the Dow Jones Industrial Average to be the leader of the market.

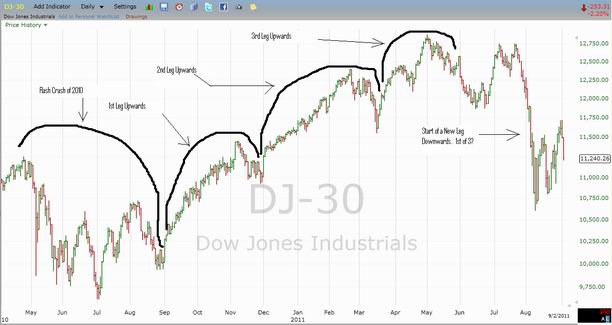

Following the "Flash Crash" of 2010 the Dow Jones Industrial Average reached a closing low of 9,686.48 on July 2nd. Since then the Dow Jones Industrial Average rallied to a closing high of 12,784.62 on May 2nd of this year. This amounted to a gain of approximately 3,098.14 points or approximately 32%. I've inserted a chart below showing the movement in the Dow since the Flash Crash.

It looks to me that the move higher by the Dow occurred in a series of 3 movements higher. As my regular readers will know, I am a big believer that the market generally has 3 legs or components to any movement in an upward or downward direction. In looking at the chart below, I have identified what I believe to have been the 3 legs higher. I feel this is confirmed by the fact that the recent market sell off has traded significantly below the March closing lows. I think there is a reasonable chance that the sell off that started in July and ended in early August may have been the 1st leg downward. It is going to take some time to know for sure, but either way I think the overall market has started an intermediate term sell off

What I am looking at is the Dow Jones Industrial Average continuing to move lower and test support in the 9,500 to 9,000 level. My best estimate at this time is that this will be the support level on the 2nd leg downward. After that it gets scary, if we break below those support levels, then the 3rd leg downward could see the Dow Jones Industrial Average trading back at the 8,000 level.

Sterling Investment Services Site Update

Since the last edition of the Sterling Weekly we have been making some upgrades to our web site (www.sterlinginvestments.com) and the services offered. One of the 1st things visitors to Sterling Investments will notice is a new design to our web pages. We have installed a new content management system and we are in the process of transitioning our legacy pages over to the new system. With several thousand legacy pages this is a time consuming process and will take some time to get fully implemented. We very much appreciate your patience during this process. As part of this process we have cleaned up our graphic images and streamlined our content and hopefully visitors will notice and appreciate the cleaner look to our site. Additionally the improvements to our content management system will allow us to offer more services to our clients; including a daily market commentary blog.

Sterling Market Commentary Blog

As part of our new services we are now publishing a blog. The primary focus of our blog is a daily market commentary. Over the course of the last 12-18 months there have been a lot of changes to the functioning of the stock market. One of the biggest being the growth in computer driven algorithmic and flash trading. While this form of trading serves to help increase the liquidity in the market, it has also dramatically changed the nature of the open of the market; specifically in my opinion it has dramatically increased the swings in the pre-market futures to the point where the expected open could change completely in the last 20 minutes prior to the open. While I still believe it is possible to engage in the form of short term trading I wrote about in the Prime Stock Newsletter, I no longer felt it was possible to publish the Prime Stock Newsletter with enough time prior to the open for it to be of meaningful value to our readers. As a result we have discontinued the publication of the Prime Stock Newsletter. Additionally I have decided to continue to write the daily commentary portion of the Prime Stock Newsletter as the main part of the Sterling Market Commentary Blog, making it free to the general public.

Additionally, the Sterling Market Commentary Blog is available as an RSS feed; and later this week we plan on having our blog available for real time email delivery as well.

|