Sterling Market Commentary for Thursday November 8th, 2012

A Look at Wednesday’s Market: The overall market moved severely lower in a broad based move that saw every sector index I track move lower on the day as well. This was a sharp sell off that looks to have inflicted serious technical damage to every sector of the market. In the commodities markets, Oil was down sharply by $4.27 to $84.44 per barrel, and Gold was lower by $1.00 to $1,714.00 per ounce. In the grain markets, Wheat was higher by $0.170 to $8.940 per bushel, and Corn was higher by $0.032 to $7.442 per bushel, while Soybeans were lower by $0.084 to $15.070 per bushel.

A Few Thoughts on Thursday’s Market: In looking at the charts from Wednesday’s trading activity it is pretty clear the market has started a new downward trend that is going to last for a reasonable period of time. I do not see this sell off being the result of the news of the weakening economy is Europe, as that news has been on the proverbial table for quite some time. There may be some credibility to this being an election story, most of the people who I know that work in the finance and investment banking field were hoping for a Romney victory. Maybe they let their emotions get the better of them, or the misjudged the mood of the country. However, even if the election effect is true, I see that as only being a very tiny factor on the markets. I think that there are serious structural issues that are coming to head in the next several years, and the only reason why the market hasn’t reflected this sooner is due to the efforts of the Fed to manipulate asset values higher. The charts very clearly show that essentially every sector of the market is in the midst of a move lower. In my opinion this is signalling a pullback in the economy, and the possibility of a recession in 2013.

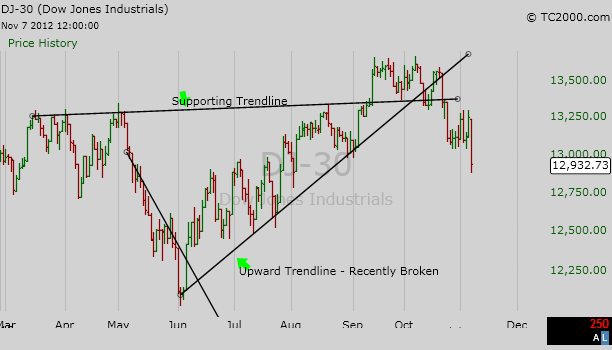

The Dow Jones Industrial Average: The Dow Jones Industrial Average closed at 12,932.73 I have lowered my upside resistance level on the Dow Jones Industrial Average at 13,000.71 on a closing basis. I now see downside support coming in at 12,715.93 and then at 12,118.57 on a closing basis. Current Expectations: I think we are starting a new trend lower in the Dow. I am expecting the Dow Jones Industrial Average to continue to move lower and test 12,715.93 and then 12,118.57 on a closing basis.

I should point out that the Dow Jones Industrial Average set a multi-year closing high of 13,610.15 in October of this year. A Bear Market is typically defined as a decline of 20% or more from the high point of the market. In this case, a bear market in the Dow Jones Industrial Average would require a decline of 2,722.03 points. This would require the Dow Jones Industrial Average to close at 10,888.12 for a bear market to be declared. I have included a chart on the Dow Jones Industrial Average below for your to review. Do I think a bear market could be on the horizon? Unfortunately, Yes. I will be providing a more detailed discussion on my thoughts in this weekend’s Sterling Weekly.

Dow Jones Transportation Average: The Dow Jones Transportation Average closed at 5,103.52 I see upside resistance on the the Dow Transportation Average at 5,215.97 and downside support at 4,873.76 and then at 4,795.28. Current Expectations: I think the Dow Transports are going to track sideways between support and resistance for the foreseeable future.

NASDAQ 100 Index ‘NDX’: The NDX closed yesterday at 2,612.69 I see upside resistance on the NDX currently at 2,623.33 and downside support at 2,458.83 on a closing basis. Current Expectations: I think the NDX is going to continue to move lower and test 2,458.83 on a closing basis.

The Bottom Line: I think the market will continue to move lower for the next few trading sessions.