Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average lost 584.12 points or approximately 5.2%, to finish at 10,620.16 It has been 3 weeks since the previous edition of the Sterling Weekly, and the market has definitely had a little bit of a rough ride since late April; with what appears to be the start of a new downward trend in the overall market and the "flash crash" a couple of Thursdays ago.

My thoughts on the "flash crash" is that it was primarily due to changes in the market cause by decimalization in the late '90s. The end of quoting stocks in fractions and quoting them in pennies narrowed the spreads which resulted in basically the end of the market maker and specialist system and gave rise to a new form of market liquidity which is dominated by a few high frequency trading firms. As a result, there are fewer firms willing to take in inventory and in the process help stabilize the market. Additionally the decentralization of trading by moving a greater percentage of the trading away from the exchanges that actually "list" the securities accelerated the down draft by not having all the exchanges follow the same rules. A good example of this is the circuit breakers that apply to 1 exchange but not all the others. At the end of the day, I do not think the "flash crash" was a result of a failure of the system, but the regulations that govern the system.

In looking at the market the big question is where are things going from here. In my review of the broad market and the various sector indices I track they all appear to have broken to the downside. Almost all of them have broken below there 40 day moving averages and appear to be heading towards their 200 day moving averages, with a handful having broken below their 200 day moving averages. This is definitely a bearish sign. Personally I think the market is doing this because the bailout in the European Union looks to me to be a combination of kicking the proverbial can down the road and some form of a Ponzi scheme. In addition to this the declining Euro is probably tipping the scales towards slower worldwide growth and lower earnings for our multi-national corporations; which at the end of the day combined with the talk of higher taxes here will lead to lower US economic growth.

So, where do I see the overall market going? Well in the August 24th, 2009 edition of the Sterling Weekly with the Dow Jones Industrial Average having closed the Friday before at 9,505.96, I looked at the retracement numbers for the rally the rally that was well under way. I thought that these numbers would be relevant because I felt that due to the economic conditions facing the country that the US was entering a long term secular bear market. To me this meant primarily two (2) things. The 1st being that the overall market was unlikely to reach its old all-time high anytime soon; and secondly and more importantly, once the market had finished retracing its downward movement it would most likely start a new and rather prolonged downward trend. This new downward trend would be rather painful to those who were caught unprepared.

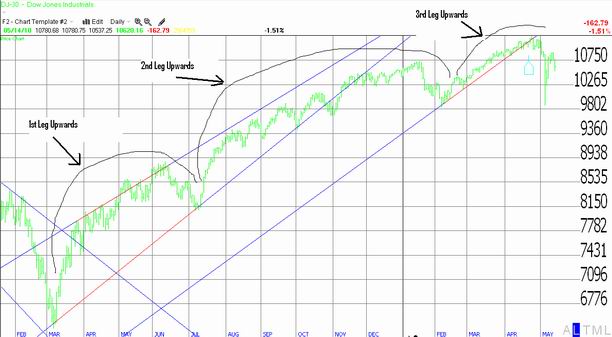

In the August 24th, 2009 edition of the Sterling Weekly, I stated that I thought a 1/3 to 2/3rds retracement would cause the Dow Jones Industrial Average to rally somewhere between 9,086.21 to 11,625.37. In the January 25th edition of the Sterling Weekly, I asked if we had completed the 3rd leg upwards in the retracement rally. While I may have been somewhat premature in calling the for the completion of that 3rd leg, it doesn't mean the market won't still head lower following the completion of that 3rd leg. Well, I have updated my chart on the Dow Jones Industrial Average to reflect what I consider to be the 3rd upward leg to the 2009 retracement rally. I have inserted that chart below for your review.

If I am correct in my analysis, the numbers I have put together look something like this. The market bottomed out on March 9th, 2009 at 6,547.05. The market appears to have peaked out at 11,205.03 on April 26th for an upward movement of 4,657.98 A 1/3 retracement of this move upwards would be 1,552.66 point which would take the Dow Jones Industrial Average down to 9,652.37. A 2/3rd retracement of the rally would take the Dow Jones Industrial Average down to 8,099.71

In my opinion a retracement is a normal and healthy part of the market, even if it a move downwards that retraces a market rally. The question that really comes crucial is if we are in a secular bear market, are we going to seriously test the lows from the spring of 2009 or possibly push through them to lower levels. Sound crazy??? Maybe, but if you think there is a realistic possibility that the US economy will double dip in 2011 following the expiration of the Bush tax cuts then maybe it is not so crazy after all.......?

|