|

|

| Sterling Weekly for the Week of March 8th, 2010 |

| A Look at the S&P Insurance Index 'IUX' |

Since the previous edition of the Sterling Weekly, the Dow Jones Industrial Average gained 240.94 points or approximately 2.3%, to finish at 10,566.20.

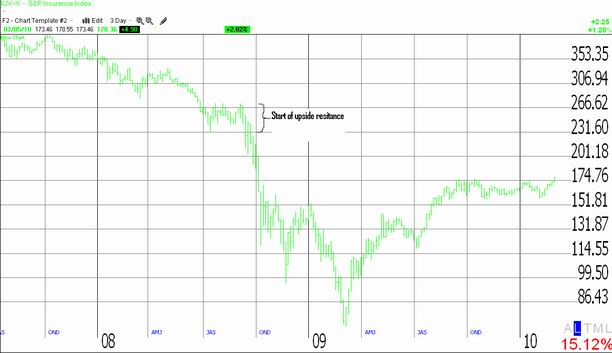

In this week's edition of the Sterling Weekly I wanted to take a look at the S&P Insurance Index 'IUX' which set a new yearly closing high on Friday. This makes the S&P Insurance Index 'IUX' one of the better performing indices over the course of the last 12 months. The 'IUX' is designed to track the performance of the US insurnace industry. I've inserted a recent chart on the 'IUX' below for your review.

While the S&P Insurance Index 'IUX' has been moving somewhat sideways since mid-September, it has also been consolidating during this period of time. This consolidation appears to be forming a base from which the 'IUX' should be able to move higher from. The 'IUX' set a new yearly closing high last week, in the process it completed a "cup pattern" with a measured move to 191.07 I've inserted a longer term chart of the 'IUX' below. An examination of this chart shows that the 'IUX' really doesn't see any upside resistance until around the 231 level. So a move to 191 doesn't seam all that unrealistic, and a move to the 231 level seams like a good possibility as well.

I looked at a variety of the Exchange Traded Funds ("ETFs") that are designed to track the different insurance indices. I found a couple that closely tracked the S&P Insurance Index 'IUX', however there was quite the disparity in average daily trading volume. The SPRD KBW Insurance ETF 'KIE' is the one that was the closest in tracking the performance of the S&P Insurance Index 'IUX', and very importantly it had some relatively decent trading volume averaging 679,000 shares per day over the last 3 months. If I was looking to profit from the expected upside movement in the 'IUX', the 'KIE' is the ETF I would buy.

|

|

| Sterling

Calendars for the Week of March 8th, 2010. |

| Date: |

Comments: |

| 03/08 |

AthenaHealth 'ATHN' announced earnings after the close. Est. $0.17 |

| 03/08 |

Casey's General Stores 'CASY' announces earnings after the clsoe. Est. $0.36 |

| 03/09 |

J. Crew 'JCG' announces earnings after the close. Est. $0.46 |

| 03/09 |

Tootsie Roll 'TR' announces earnings. Est. $0.18 Time N/A. |

| 03/10 |

American Eagle Outfitters 'AEO' announces earnings before the open. Est. $0.33 |

| 03/11 |

Aeropostale 'ARO' announces earnings after the close. Est. $0.95 |

| 03/11 |

Air Methods 'AIRM' announces earnings after the close. Est. $0.27 |

| 03/11 |

National Semiconductor 'NSM' announces earnings after the close. Est. $0.18 |

| 03/12 |

Ann Taylor Stores 'ANN' announces earnings at 8:00am ET. Est. ($0.02) |

| 03/12 |

Smith & Wesson 'SWHC' announces earnings after the close. Est. $0.01 |

The

full earnings calendar for this

week can be found (here) |

Prime

Update:

The Prime Stock Newsletter is our daily newsletter that contains commentary on the overall market, and our single best trading idea for the day! (Both Long & Short Sale Recommendations) We select this stock through a combination of technical (charting) and fundamental (financial) analysis. The Prime Stock Newsletter provides select expanded quotation information, corporate description, select recent company news, our technical analysis of the shares and our expectations, and our options recommendation for the company.

Our most recent Performance Report is now available available (here). We are proud to report 19 of our last 20 recommendation resulted in profitable trades for an average profit of $0.47/share. This is an 95% success rate.

Archived copies of our Performance Reports can be found (here).

Highlights

from Recent (20) Editions of the Prime

Stock Newsletter |

| Recommendation |

Date |

Entry

Point |

Recent

Close or Exit Price |

Profit* |

Note |

| Suncor Energy 'SU' |

Feb 03 |

$31.24 |

$30.25 |

$0.99 |

Covered on the 3rd |

| Seagate Tech. 'STX' |

Feb 17 |

$19.94 |

$20.94 |

$1.00 |

Sold on the 18th. |

* Our March 3rd recommendation of Intuit, Inc. 'INTU' @ $33.13/share, set a new yearly closing high on March 5th of $33.91/share.

* Our March 2nd recommendation of DirectTV Grp. 'DTV' @ $34.21/share, set a new yearly closing high of $34.95/share on March 5th.

* Our February 19th recommendation of VMWare, Inc. 'VMW' @ $48.26/share, set a new yearly closing high of $53.94/share on March 5th.

* Our January 29th recommendation of Boeing, Co. 'BA' @ $62.56/share, set a new yearly closing high of $67.93/share on March 5th. |

| * The per share PROFIT is a theoretical calculation based upon the opening price the day the recommendation is published and the intra day high (or low for short sales) on the exit day. The exit day is determined based upon the application of our "Rules for Trading", the implementation of "stops" within our stated policy, and may not reflect the complete or full movement of the underlying recommendation. |

|

|

Disclaimer:

The Sterling Investments series of newsletters is produced by Sterling

Investment Services, Inc. All information

used in the production has been obtained

from sources believed to be reliable and

accurate. Sterling Investment Services

does not warrant or assume any liability

for inaccuracy of the information used

to produce our publications. To receive

further information on these services

please visit our web page at: www.sterlinginvestments.com

If you would like to contact us our fax

# is (404)-816-8830 Email address is:

enelson@sterlinginvestments.com Sterling

Investment Services may hold positions

in the securities recommended or may be

providing consulting services to the companies

mentioned within this report. |

|