|

|

Sterling

Weekly for November 14th, 2005

|

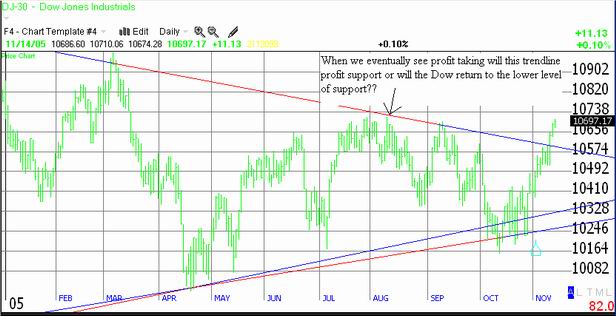

Well, the overall market as

measured by the Dow Jones Industrial

Average moved higher over the

course of the last week. For

the record the Dow advanced

110.94 points or approximately

1%. Not a bad week. For the

last couple of weeks I have

been talking about a triangle

pattern forming on the Dow and

what to expect as a result.

(To review that article please

click here) One of the things

about triangle patterns that

I have found to be different

from a lot of other patterns

that are drawn with trendlines

is that the trendlines on a

triangle pattern can be a little

fuzzy at times. What I mean

by this is that sometimes they

will be violated, giving a false

sense of a break one way or

the other only to return to

oscillating within the converging

trendlines. Currently we have

broken above the downward sloping

upper trendline on the Dow.

I am almost certainly expecting

a round of profit taking, sometimes

referred to as a pullback in

the market. Whether we return

to oscillating within this pattern

or whether that broken trendline

that was previous resistance

becomes support remains to be

seen. Time will tell and I don't

think we will need to wait long

to find out.

|

|

|

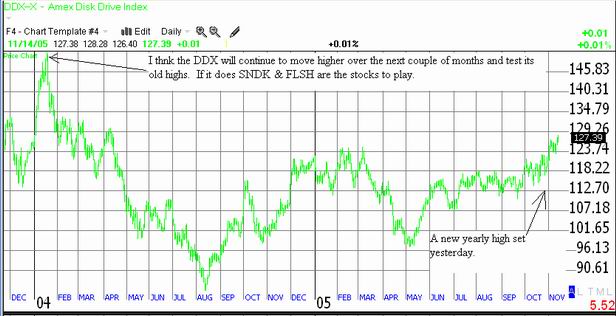

Last week I wrote about the

Amex Broker/Dealer Index 'XBD'

and Merrill Lynch 'MER' both

of which had recently set new

yearly highs. Well, both the

Broker/Dealer Index 'XBD' and

Merrill Lynch 'MER' continued

to push higher throughout the

week with both of them setting

new yearly highs again today,

Monday the 14th. Today the Amex

Disk Drive Index 'DDX' set a

new yearly high.

The 'DDX' is designed to measure

the performance of a cross section

of companies active in designing

and manufacturing electronic

data storage devices for computers,

as well as software that helps

computers interface with those

devices. The components of the

index are Sandisk 'SNDK', Adaptec

'ADPT, M-Sys. Flash 'FLSH' Advanced

Digital 'ADIC', Network Appliance

'NTAP', Quantum Corp. 'DDS',

Seagate Technology 'STX', Iomega

'IOM' (I didn't realize they

were still even in business)

Hutchinson Tech. 'HTCH', and

Maxtor Corp. 'MXO'. This is

an older sector index having

more relevance when it was established

back in 1996 than it does now.

But the fact that it is setting

a new yearly high when the personal

computer manufacturers are having

a tough year should tell us

something. A couple of these

companies don't even produce

disk drives, but they do produce

flash memory storage. You know

that memory used in an Ipod

and the memory sticks used in

digital cameras. It is the performance

of SanDisk 'SNDK' and M-Sys.

Flash Memory 'FLSH' that are

powering this index to new yearly

highs, and considering that

that the market for actual disk

drives is a bare knuckle brawl

of competition and has been

for as long as I can remember

it will probably be those 2

companies that help the 'DDX'

continue to set new yearly highs.

Personally I like 'SNDK' the

better of the two. I think the

'DDX' will continue to move

higher over the course of the

next couple of months and test

its highs of 150 set in January

of 2004. If it does SNDK and

FLSH will be rewarding to those

investors who go along for the

ride.

|

|

|

| Sterling

Calendars for the Week of November

14th, 2005 |

| Date: |

Comments: |

| Nov.

14 |

Agilent

Tech. 'A' reports earnings after the

close. Est. $0.37 |

| Nov.

14 |

Lowe's

Companies 'LOW' reports earnings.

Time N/A. Est. $0.77 |

| Nov.

14. |

Wal-Mart

reports earnings. Time N/A. Est $0.57 |

| Nov.

15 |

Abercrombie

& Fitch 'ANF' reports earnings

after the close. Est. $0.80 |

| Nov.

15 |

American

Eagle Outfitters 'AEOS' reports earnings

before the open. Est. $0.46 |

| Nov.

15 |

Anolog

Devices 'ADI' reports earnings after

the close. Est. $0.34 |

| Nov.

15 |

Home

Depot 'HD' reports earnings before

the open. Est. $0.68 |

| Nov.

15 |

JC

Penny 'JCP' reports earnings before

the open. Est. $0.92 |

| Nov.

16 |

Applied

Material 'AMAT' reports earnings at

4:30pm. Est. $0.14/share |

| Nov.

16 |

D.R.

Horton 'DHI' reports earnings before

the open. Est. $1.63/share |

| Nov.

16 |

Intuit

'INTU" reports earnings after

the close. Est. ($0.31) |

| Nov.

16 |

Medtronic

'MDT' reports earnings after the close.

Est. $0.54 |

| Nov.

17 |

Autodesk

'ADSK' reports earnings after the

close. Est. $0.30 |

| Nov.

17 |

Barnes

& Noble 'BKS' reports earnings

before the open. Est. ($0.02) |

| Nov.

17 |

Mesa

Air 'MESA' reports earnings. Time

N/A. Est. $0.31 |

| Nov.

18 |

AnnTaylor

Stores 'ANN' reports earnings before

the open. Est. $0.37 |

The

full earnings calendar for this

week can be found (here) |

|

Prime

Update:

Sterling Investment Services

is an investment research and money management

firm publishing the Prime

Stock Newsletter. The Prime

Stock Newsletter is a daily comprehensive

newsletter that is useful for investors

and traders alike. Whether you are looking

for short term trading opportunities ranging

from day trading to a couple of weeks

or if you looking to acquire a long term

portfolio at smart entry points. Subscriptions

are $50/month. A Free

2 Week Trial is currently being offered.

Highlights

from Recent editions of the Prime

Stock Newsletter |

| Recommendation |

Date |

Entry

Point |

Recent

Close or Exit Price |

Profit* |

Note |

| Caterpillar 'CAT'

shorted |

Oct.

13 |

$54.56/share |

$48.25 intra day

low on October 21st |

$6.31

|

Very negative chart

ahead of earnings. |

| Alcoa

'AA' |

Nov.

2 |

$24.30 |

$26.82 |

$2.52 |

Should still move

higher. |

| Starbucks

'SBUX' |

Nov.

1 |

28.30 |

$30.97 Nov. 7th |

$2.67 |

|

| * The

per share PROFIT is a theoretical

calculation based upon the opening

price the day the recommendation is

published and the intra day high (or

low for short sales) on the exit day.

The exit day is determined based upon

the application of our "Rules

for Trading", the implementation

of "stops" within our stated

policy, and may not reflect the complete

or full movement of the underlying

recommendation. |

|

Dow Jones Industrial

Average (INDU)

Current Opinion:

Closed @ 10,697.17 Last

Signal: None.

Current Expectations: I am expecting

the Dow Jones Industrial Average to

move higher and test 10,705.55 and then

10,940.55 on a closing basis. I would

not be surprised to see a short term

pullback after the Dow tests the 10,705.55

level before it rallies towards 10,940.55

|

The

S&P 500

Current Opinion:

Closed @ 1,233.71 Last Signal:

none Current Expectation:

I am expecting the S&P 500 to move

higher and test

1,241.48 and then 1,245.04 on a closing

basis.

|

The

NASDAQ 100 (NDX)

Current Opinion:

Closed @ 1,651.90 Last

Signal: none

Current Expectations:

I am expecting the NDX to move higher

and test 1,675.03 and then 1,720.91 |

CBOE

Ten Year Treasury Index (TNX)

Current Opinion:

Closed @ 4.604% Last

Signal: Called Lower after the

close of trading on November 8th at 4.565%

Current Expectations:

This index should move lower and test

then 4.508% on a closing basis. However

this is probably a shorter term pullback

before the index moves back higher. |

Disclaimer:

The Sterling Investments series of newsletters is produced by Sterling

Investment Services, Inc. All information

used in the production has been obtained

from sources believed to be reliable and

accurate. Sterling Investment Services

does not warrant or assume any liability

for inaccuracy of the information used

to produce our publications. To receive

further information on these services

please visit our web page at: www.sterlinginvestments.com

If you would like to contact us our fax

# is (404)-816-8830 Email address is:

enelson@sterlinginvestments.com Sterling

Investment Services may hold positions

in the securities recommended or may be

providing consulting services to the companies

mentioned within this report. |

Last

Week's Edition of the Sterling Weekly

|

|