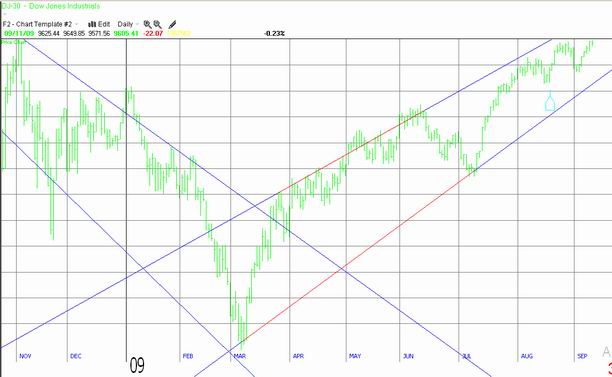

The overall market as measured by the Dow Jones Industrial Average rose 61.21 points, or approximately 0.006%, to finish @ 9,605.41 since the previous edition of the Sterling Weekly. In the August 31st edition of the Sterling Weekly I discussed a pair of trendlines that I thought were influencing the market and might lead to influence the market. Which I feel they did, as the market pulled back sharply and then slowly rallied to remain within the trendlines.

Time will tell if these trendlines are relevant. However, if they are, then I would not be surprised to the market continues to move higher through the end of this week, and then turn lower following the Labor Day Holiday Also, please note that this week's economic calendar has some rather weighty news towards the end of the week with jobless claims on Thursday and the unemployment rate on Friday. Either one of those announcements could move the market sharply, or not at all. I've inserted an updated version of the chart of the Dow Jones Industrial Average for your review. While I've always considered drawing trendlines to be more of an "art" than a "science," you can see there is some validity to the trendlines I've drawn.

In the June 22nd edition of the Sterling Weekly I discussed the price of Gold, which then had closed at $979.28 per ounce, and that I felt was on an upward trend. I also stated that I felt that "A close above $993.25 per ounce would complete ... the pattern and provide a measure to $1,117.37 per ounce." I also stated "A closing trade above $1,002.66 per ounce would ... provide for a measured move to $$1,283.02 per ounce." Well, on September 2nd, Gold moved up $21.90 per ounce to close @ $977.10 per ounce, and while it hasn't close yet above $1,002.66 per ounce it has had a couple days with intra-day trades above the $1,000 level. So with Gold obviously moving higher, I thought now would be a good time to look at how we could profit from from the upward movement in the price of Gold.

On January 6th, 2006 I published a report titled "A comprehensive Technical Analysis of the Philadelphia Gold & Silver Index 'XAU'." At that point in time there were a limited number of Gold Exchange Traded Funds 'ETS' and the few that existed had only been in existence for about a year. As a result, they had a limited amount of liquidity. Since then a lot has changed. ETF's have developed a much longer track record and a significantly greater amount of liquidity. Back in 2006, I felt that the best way to play the price of Gold was to buy the 'XAU' or components of the 'XAU'. Now I feel the 'XAU' doesn't track the price of Gold accurately enough, and a much better way to play the movement in Gold is to buy a Gold ETF. In reviewing the available information on the various Gold ETF's I feel that the best one to look at is the SPDR Gold Shares 'GLD'. My analysis indicates that this ETF is the most liquid of the Gold ETF's with an average daily trading volume of nearly 19 million shares over the last 30 days, and just over 10.5 million shares per day over the last 90 days. The ETS is priced at approximately 1/10th the price of Gold, making it somewhat economical to trade. Furthermore my analysis indicates that it tracks the price of Gold to within a couple of dollars per ounce. So here are the numbers I am looking at; if the price of Gold hits $1,117.37 per ounce, then the 'GLD' should be priced at approximately $110.38 per ETF share. If the price of Gold hits $1,283.02 per ounce, then the 'GLD' should be priced at approximately $128.34 per ETF share. I've inserted charts of the price of Gold and the 'GLD' below for your comparison. The decision is yours, but if Gold closes above $1,002.66 per ounce, I'll probably buy a few shares of the 'GLD'

Chart of the Price of Gold.

Chart of the SPDR GOLD ETF Chart of the SPDR GOLD ETF

PS. It is worth noting that we have a fairly heavy economics calendar this week. PS. It is worth noting that we have a fairly heavy economics calendar this week.

|