|

|

Sterling

Weekly for August 29th, 2005

|

| Monday

Morning: |

Well,

for the last couple of weeks I

have been searching for a quality

chart of the price of oil, which

hasn't been easy to find unless

you are a commodities trader,

which I am not. However I have

been able to review a couple of

charts of oil prices, and I am

relatively happy to say that I

just don't see the price of oil

moving much higher from its current

levels. It may hit $70 barrell,

but that should be about it. I

will keep looking to see if I

can find that better quality chart

to provide a more accurate reading

on future oil prices. |

| Tuesday

Morning/Afternoon: |

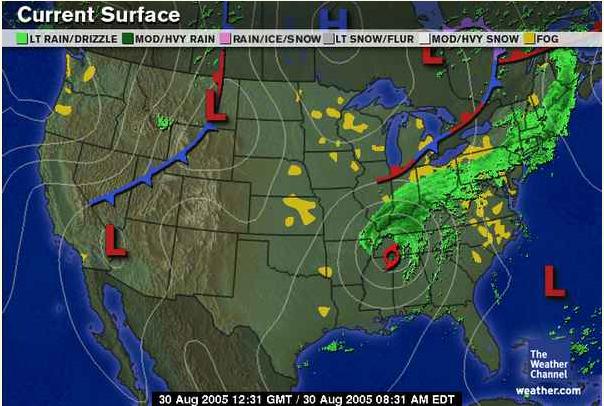

Well,

it is now Tuesday morning and

I have been watching the reports

on the damage caused by hurricane

Katrina. I've seen several analyst

on the financial channels talking

about how long term this storm

is not going to cause significant

problems and might actually help

some companies. I do not think

so! Living in Atlanta you get

a pretty good spot from which

to watch the hurricane season

unfold, and you do pay attention

to them, particularly if you like

to spend your Sunday afternoons

on the lake as I do. This hurricane

did not go and hit some beach

community populated by rental

condos and real estate agents.

This hurricane nailed an especially

vulnerable city and one of the

major transportation lifelines

for this country. I fear that

this is going to have a major

disruptive effect on things for

some time to come. Even worse

for New Orleans, as the weather

map below shows, it is continuing

to rain in the Ohio River Valley,

which drains into the Mississippi

river. All this water will flow

downstream and keep the water

level rising in New Orleans for

several days to come. I doubt

anyone honestly knows how long

it will be before serious repairs

can begin, the dikes can be repaired

and the city can be pumped dry.

Only time will tell.

|

|

| Sterling

Calendars for the Week of August 29th,

2005 |

| Date: |

Comments: |

| 8/29 |

China Eastern Airlines

'CEA' reports earnings after the close.

est. N/A |

| 8/29 |

China Oilfield Services

'CHOL.PK' reports earnings before

the open. est. N/A |

| 8/29 |

China Petroleum

& Chem. 'SNP' reports earnings

at 3:30am. est. N/A |

| 8/29 |

China South Airlines

'ZNH' reports earnings before the

open. est. N/A |

| 8/30

|

Zale Corp. 'ZLC'

reports earnings before the open.

est. $0.08 |

| 8/31 |

China Telecom 'CHA'

reports earnings at 4:00am. no est. |

| 9/01 |

Catalyst Semiconductor

'CATS' reports earnings after the

close. est. $0.03 |

| 9/01 |

Ciena Corp. 'CIEN'

reports earnings before the open.

est. ($0.04) |

| 9/01 |

Del Monte Foods

'DLM' reports earnings before the

open. est. $0.05 |

| 9/01 |

H&R Block 'HRB'

reports earnings after the close.

est. ($0.07) |

|

Prime

Update:

Sterling Investment Services

is an investment research and money management

firm publishing the Prime

Stock Newsletter. The Prime

Stock Newsletter is a daily comprehensive

newsletter that is useful for investors

and traders alike. Whether you are looking

for short term trading opportunities ranging

from day trading to a couple of weeks

or if you looking to acquire a long term

portfolio at smart entry points. Subscriptions

are $50/month. A Free

2 Week Trial is currently being offered.

Highlights

from Recent editions of the Prime

Stock Newsletter |

| Recommendation |

Date |

Entry

Point |

Recent

Close or Exit Price |

Profit* |

Note |

| Autodesk 'ADSK' |

Aug

16 |

$37.75/share |

$42.19 intra day

high on Aug 25th. |

$4.44 |

|

| DR Horton

'DRI' Shorted |

Aug

22 |

$35.07 |

$30.15 intra day

low on Aug. 25th |

$4.92 |

|

| Massey

Energy 'MEE' |

Aug

10 |

$46.46 |

$49.45 intra-day

high on Aug 22nd |

$2.99 |

Should move higher. |

| * The

per share PROFIT is a theoretical

calculation based upon the opening

price the day the recommendation is

published and the intra day high (or

low for short sales) on the exit day.

The exit day is determined based upon

the application of our "Rules

for Trading", the implementation

of "stops" within our stated

policy, and may not reflect the complete

or full movement of the underlying

recommendation. |

|

Dow Jones Industrial

Average (INDU)

Current Opinion:

Closed @ 10,412.82 Last

Signal: Called Lower on August

5th with the previous day's close of

10,610.10

Current Expectations: I am expecting

the Dow Jones Industrial Average to

pullback over the short term and move

lower and test 10,368.61. If that level

fails to provide support and generate

a move higher, then I the Dow should

continue to move lower and test 10,263.82

|

The

S&P 500

Current Opinion:

Closed @ 1,208.41 Last Signal:

Called Lower on August 5th with the

previous day's close of 1,235.86 Current

Expectation: I am expecting the S&P

500 to to pullback over the short term

and test 1,195.98 and then 1,191.14 if

the support at 1,195.98 fails to hold.

|

The

NASDAQ 100 (NDX)

Current Opinion:

Closed @ 1,565.73 Last

Signal: Called Lower on August

5th with the previous day's close of 1,608.74

Current Expectations: I am expecting

the NDX to pullback over the short term

and test 1,547.30 and then 1,533.27 on

a closing basis. |

CBOE

Ten Year Treasury Index (TNX)

Current Opinion:

Closed @ 4.090% Last

Signal: Called Lower on August

29th with the previous day's close of

4.189% Current Expectations:

The TNX should end its downward trend

and move higher test 4.258% and then 4.278%

on a closing basis. (WOW, I am not sure

what happened here other than a flight

to safety.) |

Disclaimer:

The Sterling Investments series of newsletters is produced by Sterling

Investment Services, Inc. All information

used in the production has been obtained

from sources believed to be reliable and

accurate. Sterling Investment Services

does not warrant or assume any liability

for inaccuracy of the information used

to produce our publications. To receive

further information on these services

please visit our web page at: www.sterlinginvestments.com

If you would like to contact us our fax

# is (404)-816-8830 Email address is:

enelson@sterlinginvestments.com Sterling

Investment Services may hold positions

in the securities recommended or may be

providing consulting services to the companies

mentioned within this report. |

Last

Week's Edition of the Sterling Weekly

|

|