Small Cap. Research Report / Initiation of Coverage

Sun River Energy, Inc.

BUY RATING

Corporate Information |

Market Information |

10200 West 44th Ave. |

Ticker Symbol: |

SNRV |

Suite # 210-E |

Exchange: |

OTC BB |

Wheatridge, Co. 80033 |

Recent Price: |

$0.30 |

Office 303-940-2090 |

Shares Outstanding: |

15.66 Million |

www.sunriverenergy.com |

Estimated Float: |

5.33 Million |

|

Average Daily Volume |

7,800 shares |

|

Market Capitalization: |

$4.38 Million |

Opinion & Recommendation:

Sterling Investment Services is initiating coverage on the shares of Sun River Energy, Inc.: (SNRV: OTC BB) with a Buy Rating. We feel the company’s shares are undervalued at the current price level and are suitable for accumulation up to a price of the $1.25 per share range. We believe that on a longer term basis the shares of Sun River have the potential for significant price appreciation above that level.

Company Description:

Sun River Energy’s operations are in the exploration and development of oil and gas in North America including Coal Bed Methane (CBM) natural gas in the Rocky Mountain region. Sun River has acquired 120,000 acres of a mixture of fee oil and gas mineral interest, some coal bed methane fee interest, 30,000 acres approximately of other fee mineral rights and 4,000 gross acres of leases that they have begun to explore for methane. The Company primarily has 120,000 acres in Colfax County with approximately 12,000 acres in the Raton Basin area of New Mexico

The company plans to produce coal bed methane from the Raton Basin. Coal bed methane is a form of natural gas extracted from coal beds. It is often called 'sweet gas' because of its lack of hydrogen sulfide. To date the company has drilled three (3) wells on the Meyer’s Ranch property and struck coal bed methane in two (2) wells.

Raton Basin:

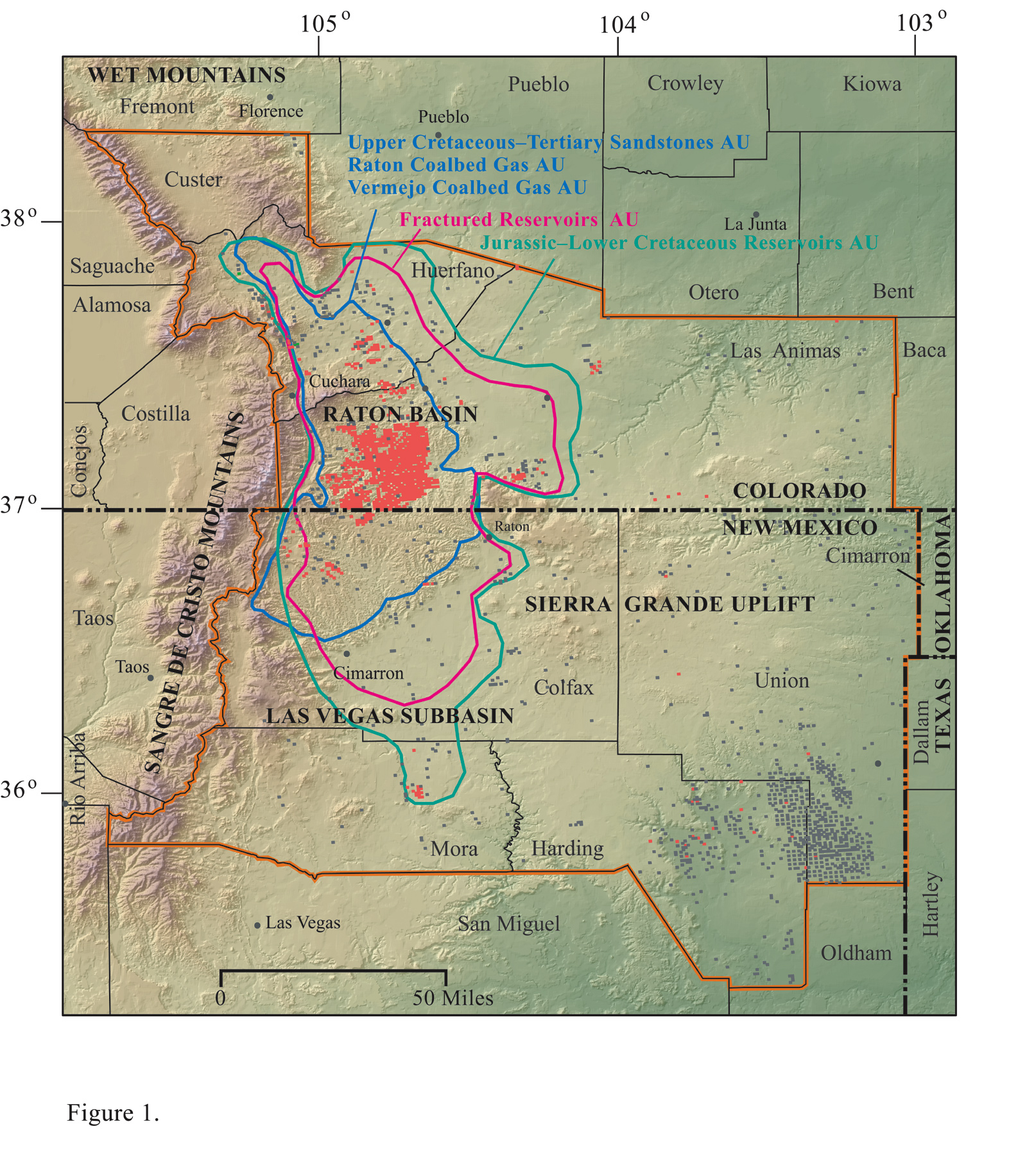

The basin is a large asymmetric sedimentary trough that developed along the western margin of an ancient Rocky Mountain seaway during the Cretaceous and Tertiary period between 65 to 45 million years ago. Today, the geologic history of what was once a lush tropical coastline and alluvial plain cut by meandering rivers, which subsequently underwent deep burial, tectonism, and uplift, is recorded in the rocks of the region; the continued exploration of the basin by geologists is increasing the understanding of the coal bed methane resource base and identifying new hydrocarbon systems and additional unconventional reservoir types.

The Raton Basin covers an area that is approximately 80 miles long, north to south, and about 50 miles wide, east to west, encompassing southeastern Colorado and northeastern New Mexico. The Raton Basin contains two coal-bearing formations, the Vermejo formation coals located at depths of betw een 450 and 4,000 feet and the shallower Raton formation coals, located at the surface to approximately 3,000 feet in depth. Production from the Vermejo coals represents approximately 79% of the total production from the Raton Basin and approximately 78% of the total proved reserves in the Raton Basin. To date, the majority of methane production has been from the Vermejo formation coals in Colorado; and New Mexico. een 450 and 4,000 feet and the shallower Raton formation coals, located at the surface to approximately 3,000 feet in depth. Production from the Vermejo coals represents approximately 79% of the total production from the Raton Basin and approximately 78% of the total proved reserves in the Raton Basin. To date, the majority of methane production has been from the Vermejo formation coals in Colorado; and New Mexico.

Development History:

Exploration for coal bed methane in the Raton Basin began in the late 1970s and continued through the late 1980s, with several companies drilling and testing more than 100 wells during this period. The absence of a pipeline to transport gas from the Raton Basin prevented full-scale development until January 1995, when Colorado Interstate Gas Company completed the construction of the Picketwire Lateral.

Prior to this, coal had been mined throughout the region starting in approximately 1875. The Morely mine located near the northwestern corner of the Raton Basin is generally regarded as the most gaseous mine in the US. In 1881 the Colorado Coal and Iron Company located the first steel-making blast furnace in the region in Pueblo, Co. The coal from this region was highly sought after for use in steel making due to its high gas content which caused the coal to burn hotter and make better quality steel. Additionally the Sugarite Mine located south and east of Sun River’s mineral leases in the Raton Basin is also regarded as a very gassy mine. Coal Mining began to decline throughout the region in the 1950s and 1960s.

In December of 2007, Pioneer Natural Resources Company (NYSE: PXD) acquired an interest in 30,000 net acres in the Raton Basin for $205 million. Pioneer estimates that this acreage contains approximately 95 Bcf of proved reserves. *

* Source Pioneer Natural Resources 2007 Form 10-K filed with the SEC.

Wells Drilled

To date the company has expended the majority of its efforts on exploring a coal bed methane (CBM) prospect located in the Raton Basin of Northern New Mexico. Sun River has drilled three (3) wells, Meyers 1, 2, & 3, to date. The company has encountered and tested coal bed methane gas in two (2) wells.

The Meyers # 1 was drilled to a depth below 1,200 feet. The total coal thickness appeared to be over 60 feet in the Raton & Vermejo formations. The well has been perforated in 10 zones.

The Meyers # 2 was drilled to a depth of 1,625 feet. The total coal thickness is 30 feet in all Vermejo formation. Gas has been produced in testing on this well.

The Meyers # 3 was drilled to a depth of 1,100 feet. Logging of the well has been completed and it showed over 50 feet of gas sands and coals.

Recent Developments:

Sun River announces that it has executed a Farmout Agreement with Myriad Resources, Inc. on approximately 17,000 acres of its northern New Mexico property. The Farmout provides a checkerboard pattern on about 11,000 acres and alternating half mile wide strips on approximately 3,000 acres. The Farmout contemplates testing through the Pierre Shale and requires drilling on or before June 1, 2009 with additional wells each 120 days thereafter. **

** Source: Sun River Form 8-K filed September 5th, 2008.

Industry:

Sun River Energy, Inc. “SNRV” is an independent oil & gas producer. Our industry research indicates that there are over 125 public companies within this industry group with a combined market cap in excess of $100 billion dollars. Our research indicates that the company’s within this industry trade at an average of 18.5 times earnings and approximately 3.48 times book value. Due to the exploration and development nature of Sun River Energy, we feel that the best valuation method is valuing the company based upon a multiple of book value.

We have selected a gross section of three (3) companies from within the industry that we feel reflect the overall industry segment, yet show some diversity in their primary valuation methods. These companies have been presented on the next page as comparisons for Sun River.

Comparables:

|

Sun River

(SNRV) |

American Oil

(AEZ) |

Houston Am.

(HUSA) |

Vaalco Energy (EGY) |

Industry Avg. |

Share Price |

$0.30 |

$2.80 |

$6.01 |

$6.62 |

N/A |

Market Cap. |

4.38 Mill |

$134 Mill. |

$168 Mill |

$385 Million |

N/A |

Revenue |

N/A |

$2.60 Mill |

$9.26 Mill |

$169 Million |

N/A |

Price/Earnings |

N/A |

N/A |

35.7 |

15.5 |

18.50 |

Price/Sales |

N/A |

48.0 |

15.9 |

2.35 |

N/A |

Price/Book *** |

0.56 |

1.46 |

5.82 |

2.68 |

3.48 |

*** The book value of Sun River Energy has been calculated by Sterling Investment Services based upon internally generated estimates, and through consulting services provided to Sun River by Coral Capital Partners, Inc. (www.coralcapital.com)

Our Analysis:

Our analysis of Sun River indicates that the leases owned by the company give the company a book value of approximately $0.50/share. This does not count the value of any gas reserves that might exist on the property. We believe that those reserves, if any, are included in the asset calculations for Sun River would indicate a book value substantially higher than our current estimates.

Our analysis of the farm out program with Myriad Resources indicates that it has the potential to provide the company with a significant income stream. This income stream would be able to fuel a faster development of the Meyer’s Ranch property. Additionally as the company brings production on line from the wells it has already drilled and plans to drill we believe the company has the potential to show significant earnings per share.

We feel that the shares of Sun River Energy ‘SNRV’ are undervalued at their current levels. Our valuation model suggests a potential value on the company of approximately $1.75/share. As a result we feel that comfortable recommending the accumulation of the shares of ‘SNRV’ up to a price level of approximately $1.25 per share.

For additional information on Sun River Energy, please click (here)

Disclaimer: The Sterling Investments series of newsletters is produced by Sterling Investment Services, Inc. (www.sterlinginvestments.com) All information used in the production of this report has been obtained from sources believed to be reliable and accurate. Sterling Investment Services does not warrant or assume any liability for inaccuracy of the information used to produce our publications. To receive further information on these services please visit our web page at: www.sterlinginvestments.com If you would like to contact us our fax # is (678)-530-1017 Email address is: enelson@sterlinginvestments.com Sterling Investment Services may hold positions in the securities recommended or may be providing consulting services to the companies mentioned within this report. Sterling Investment Services, Inc. has not been paid any fee for the production of this report. However in the future, Sterling Investment Services may charge fees for the production of follow up reports or services. Additionally an affiliated company of Sterling Investment Services, Coral Capital Partners, Inc. (www.coralcapital.com) has provided consulting services to Sun River Energy which included business plan development and writing, and financial modeling. Coral Capital Partners was paid a fee for these services which included a combination of cash and warrants which was renegotiated into an all stock position. As a result Coral Capital Partners owns 99,998 shares of Sun River Energy, Inc. which it may elect to sell at any point in time irrespective of the opinions contained within this report. |