Small Cap. Research Report

1st Follow Up Report

February 2nd, 2010

Sun River Energy, Inc.

BUY RATING

Corporate Information * |

Market Information * |

7609 Ralston Road |

Ticker Symbol: |

SNRV |

Arvada, Co. 80002 |

Exchange: |

OTC BB |

Office 303-940-2090 |

Recent Price: |

$1.55 |

www.sunriverenergy.com |

Shares Outstanding: |

18.38 Million |

|

Estimated Float: |

9.58 Million |

|

Average Daily Volume |

5,900 shares |

|

Market Capitalization: |

$28.5 Million |

* Source www.finance.yahoo.com

Opinion & Recommendation:

Sterling Investment Services is updating its initial report on Sun River Energy, Inc.: (SNRV: OTC BB) with this 1st Follow Up Report. We are maintaining our Buy Rating. Sterling Investment Services initiated coverage on October 1st, 2008 on the shares of Sun River Energy ‘SNRV’ when they were priced at $0.30/share. Since then they have reached a high of $2.73/share, and have recently pulled back to the current $1.55/share level. The company has experienced the following developments over the course of the last 15 months since our initial report:

- The engagement of Thomasson Partners Associates, Inc. (“TPA”): TPA is a premier seismic prospecting firm which specializes in large projects, starting at half a trillion cubic feet of natural gas in potential.

- The addition of new management to the company: The company has added three (3) new individuals to its senior management team, and an additional three (3) individuals to its advisory board.

- New discoveries in the Raton Basin: One of the company’s competitors has discovered what looks to be a very promising find in the Pierre Shale of the Raton Basin. Additionally there is pipeline expansion occurring in the Raton Basin as well.

- The proposed acquisition of the Raven Wing Resources: This acquisition will provide the company with properties in Montana, Wyoming, and Utah with significant development potential.

We believe the company’s shares are undervalued at the current price level and are suitable for accumulation up to a price range of $5.00 per share. We believe that on a longer term basis the shares of Sun River have the potential for significant price appreciation above that level.

Company Description:

Sun River Energy’s operations are in the exploration and development of oil and gas the Rocky Mountain region, including Coal Bed Methane (CBM) natural gas. Sun River has acquired 120,000 acres of a mixture of fee oil and gas mineral interest, some coal bed methane fee interest, 30,000 acres approximately of other fee mineral rights and 4,000 gross acres of leases that they have begun to explore for methane. The Company primarily has 120,000 acres in Colfax County with approximately 12,000 acres in the Raton Basin area of New Mexico.

Raton Basin:

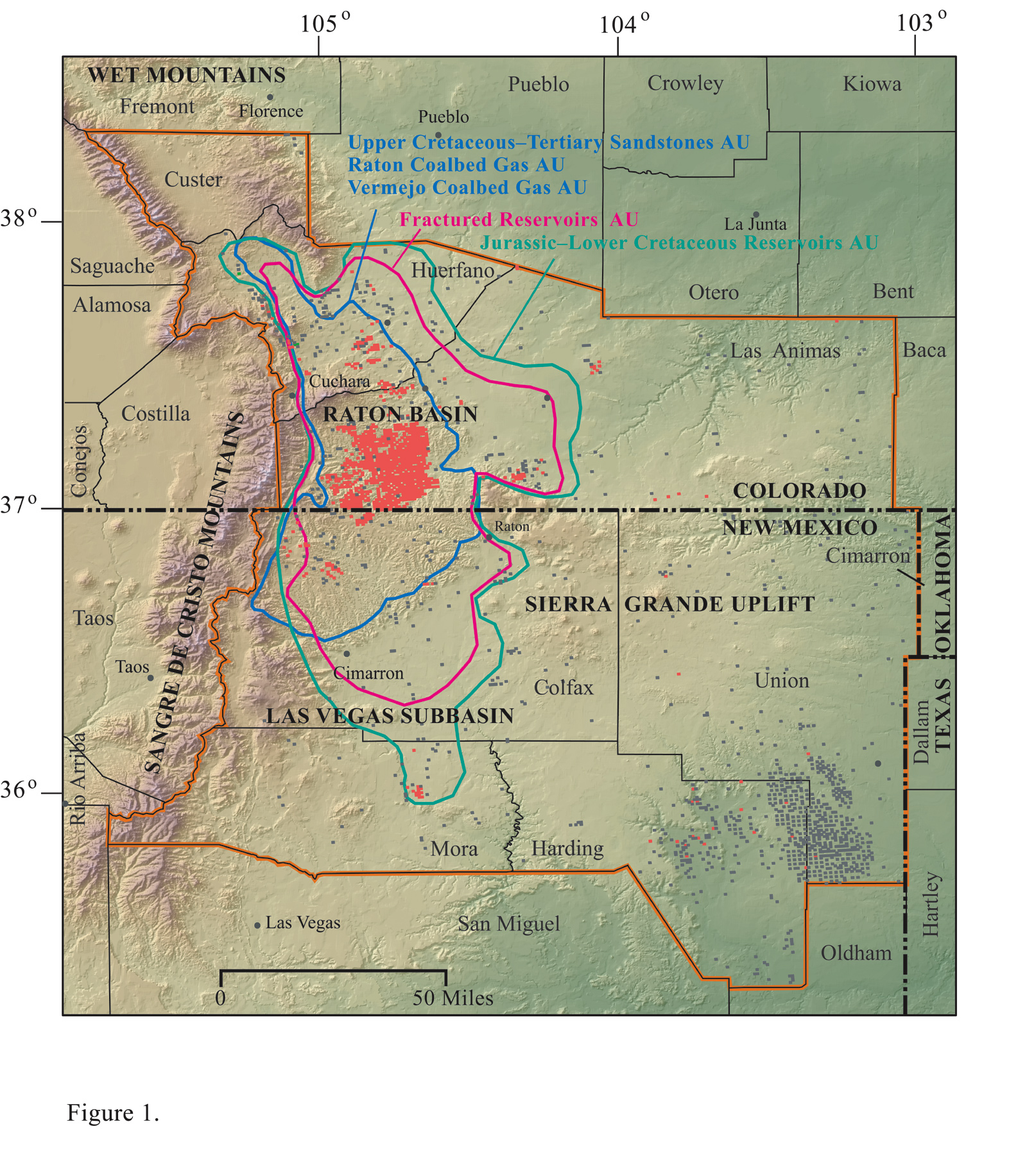

The basin is a large asymmetric sedimentary trough that developed along the western margin of an ancient Rocky M ountain seaway during the Cretaceous and Tertiary period between 65 to 45 million years ago. Today, the geologic history of what was once a lush tropical coastline and alluvial plain cut by meandering rivers, which subsequently underwent deep burial, tectonism, and uplift, is recorded in the rocks of the region; the continued exploration of the basin by geologists is increasing the understanding of the coal bed methane resource base and identifying new hydrocarbon systems and additional unconventional reservoir types. ountain seaway during the Cretaceous and Tertiary period between 65 to 45 million years ago. Today, the geologic history of what was once a lush tropical coastline and alluvial plain cut by meandering rivers, which subsequently underwent deep burial, tectonism, and uplift, is recorded in the rocks of the region; the continued exploration of the basin by geologists is increasing the understanding of the coal bed methane resource base and identifying new hydrocarbon systems and additional unconventional reservoir types.

The Raton Basin covers an area that is approximately 80 miles long, north to south, and about 50 miles wide, east to west, encompassing southeastern Colorado and northeastern New Mexico. The Raton Basin contains two coal-bearing formations, the Vermejo formation coals located at depths of between 450 and 4,000 feet and the shallower Raton formation coals, located at the surface to approximately 3,000 feet in depth. Production from the Vermejo coals represents approximately 79% of the total production from the Raton Basin and approximately 78% of the total proved reserves in the Raton Basin. To date, the majority of methane production has been from the Vermejo formation coals in Colorado; and New Mexico.

The Raton Basin also contains the Cretaceous Pierre Shale, which occurs at depths of 4,000 to 6,000 feet in the Raton Basin. Since this shale is typically greater in depth than the traditional coal bed methane that is found in the Raton Basin it is typically seen as a bonus to companies with existing coal bed methane leases. While there has been limited exploratory activity into the Pierre Shale, early indications, mostly by Pioneer Natural Resources have been very promising.

To date the company has expended the majority of its efforts on exploring a coal bed methane (CBM) prospect located in the Raton Basin of Northern New Mexico. Sun River has drilled three (3) wells, Meyers 1, 2, & 3, to date. The company has encountered and tested coal bed methane gas in two (2) wells. Additional information on the 3 wells drilled can be found in our initial report dated October 1st, 2008 and available at: http://www.sterlinginvestments.com/research/snrv/

Recent Developments:

There have been several significant developments concerning the company that are worth taking notice. We feel these developments may provide insight into the future direction of the company.

Thomasson Partners Associates, Inc.

On March 13th, 2009 the company announced it had entered into a consulting agreement with Thomasson Partners Associates, Inc. (www.tpaexpl.com) a premier seismic prospecting firm which specializes in large projects, starting at half a trillion cubic feet of natural gas in potential. Between 1992 and 2006, Thomasson Partners has discovered proved reserves of 789 billion cubic feet for its clients who have had 560 wells completed out of 639 drilled 1. The agreement with Sun River calls for Thomasson Partners to perform geological, geophysical, geochemical exploration and engineering in Sun River’s Colfax County properties in New Mexico.

On July 9th, 2009, Sun River Energy announced that Thomasson Partners had delivered the Interim Report on Sun River’s Colfax County New Mexico Property. The company reported that Thomasson Partners concluded “there are indicators of an older (Pennsylvanian age, 300 million year old) buried basin ('Sub-basin or Elevator Basin') in the area of the Company's Acreage.” The release further stated “Elevator basins represent a significant exploration target due to their geologic setting. A combined source and reservoir rock package is sealed, buried, and matured to create hydrocarbons. In theory, hydrocarbons are trapped in the sub-basin, which forms a resource-play target: an exploratory well that penetrates the sub-basin and is properly completed may be productive. An elevator basin in the Tucumcari Basin south of the Company's prospect area is currently the subject of an active exploration and production program.” Further exploration is planned to determine a drill site for an exploratory well. 2

It should also be noted that Shell Western Exploration & Production has been exploring the Tucumcari basin. 3

Management Changes

In the 15 months since our initial report, Sun River has made the following changes to its management which we believe strengthen the company’s management team and brighten its future prospects with respect to developing its existing properties.

Jay Leaver, President: Mr. Leaver is Executive Vice President of Thomasson Partner Associates (TPA), an oil and gas play generation firm that is highly respected in the industry. After graduating with a B.Sc. in Geological Engineering from the Colorado School of Mines in 1986, Mr. Leaver gathered experience in geology, geochemistry, and geophysics in both the petroleum and mining fields before joining TPA as a junior geologist in 1991. He later became a Project Manager, and has been a team member involved in several important oil and gas discoveries. During this time, Mr. Leaver worked on projects in the Illinois, Michigan, and Appalachian Basins, as well as the Williston and several other Rocky Mountain Basins plus the Basin and Range area, where he developed in-depth familiarity with the geology and production of a wide variety of petroleum-producing provinces.

Joe Kelloff, Chief Operating Officer: Appointed on October 20th, 2009. In May 1994, Mr. Kelloff received his Bachelor of Science in Petroleum Engineering from the Colorado School of Mines. He has been a member of the Society of Petroleum Engineers since 1992 and has been a member of CM Production, LLC's Board of Advisors since 2008.

From 1994 to 2000, Mr. Kelloff held several positions with Mobile Exploration and Producing U.S., Inc. where from 1994 to 1997, he worked as a Production Engineer and from 1996 to 1997, he worked as a Business Analyst. In addition, while with Mobile Exploration and Producing, U.S., from 1997 to 1999, he worked as a Production Engineer, and from 1999 to 2000, he was an Operations/Surveillance Engineer.

In 2000 until 2003 Mr. Kelloff worked as an Operations Engineer for Merit Energy Company. He was a District Engineer for Patina Oil and Gas Corporation from 2002 to 2005. From 2005 to 2006, he was a Manager - E&P Planning at Hess Corporation. He was a Director of Western Production at Petroleum Development Corporation from 2006 to 2008.

James Sullivan: Vice President of Land Management: Appointed October 20th, 2009. Mr. Sullivan has over 36 years experience as a Petroleum Landman and has been providing independent petroleum land services since 1978. Before going independent, he was employed by Trend Exploration, Ltd, Petro-Lewis Corporation and Husky Oil Company as an Area Land Manager. Prior to forming Energy West Corporation in 1999, he operated under Energy West Services, LLC and as a sole proprietor. Since 1978, Energy West/Sullivan has represented over 100 different clients and partners in various facets of petroleum land and exploration work. These relationships have culminated in leasing over 5.5 million acres of mineral leasehold. Mr. Sullivan has also negotiated both on-shore exploration contracts and offshore concessions, consulted for commercial and investment banking firms, served as an expert witness and performed non-producing acreage evaluations. Additionally, Mr. Sullivan, through Energy West, participates in exploration projects as an investor/consultant with industry partners. Energy West/Sullivan also develops and sells its own independent projects.

New Members to the Executive Advisory Board:

Terry J. Mather: Dr. Mather received his undergraduate degree from the University of Wisconsin and his MS and Ph.D. in Geology from the University of Colorado, completing his academic work in 1970. Dr. Mather's thirty nine year industry related career includes over six years with Shell Oil Company where he was responsible for stratigraphic studies in the Rockies, prospect generation in Illinois, Wyoming, Montana and Colorado and was among the first to apply stratigraphic geophysical analysis to plays. While at Shell, Dr. Mather chaired the source rock, generation, migration and hydrocarbon volumetrics team for the Gulf of Alaska sale. Dr. Mather has worked for Superior Oil Company and Houston Oil and Minerals as Lead Explorationist and Senior Geologist respectively. He was responsible for supervision and prospect generation leading to the discovery of significant hydrocarbons in the Green River Basin and western Montana. Dr. Mather was part of a select team who founded High Plains Exploration where he originated and sold a major, high potential frontier play. Dr. Mather co-founded Lariat Exploration, Inc. in Denver where he was directly responsible for significant discoveries in Kansas and the D-J Basin. Lariat had an exceptional track record for the more than ten years Dr. Mather was an officer and explorationist. Dr. Mather was employed by HS Resources as Team Leader and Senior Explorationist overseeing multi-million dollar programs in southwest Kansas, northwest Colorado and the Green River Basin.

W. Jack Ford, CPG., PG.: Mr. Ford is currently a consultant in Petroleum Management and Geologic Petroleum Exploration. He is a Certified Petroleum Geologist, Certified Professional Geologist, and Registered Professional Geologist (Wyoming). Mr. Ford has over 50 years of domestic and international experience in all aspects of petroleum and other mineral exploration, development, production, and resource utilization, as well as evaluation of environmentally sensitive properties and hydrogeologic determination of contaminated areas. He was awarded Bachelor and Master of Science degrees from the University of Oklahoma. Mr. Ford has held positions from field geologist to high management including President of a public oil and gas company. The last 13 years was spent with the New Mexico Energy, Minerals and Natural Resources Department dealing with oil, gas, mining and environmental regulatory issues.

Erwin Single: Mr. Single was employed 15 years with Shell Oil Company, advancing in technical and management capacities to the level of Division Geologist where he was responsible for all geological activities in the Rocky Mountain Region with a staff of 50 people. Since leaving Shell, Mr. Single has been a founder, director and Executive Vice President of Exploration and Production for two independent oil companies. During his career, Mr. Single was responsible for all phases of operational activity related to exploration and production. This included the management, planning, and coordination of geology, geophysics, engineering, lease acquisition, exploration and development drilling, well evaluation and completion, and production operations. He coordinated drilling operations for over 400 wells, supervised some 35 production personnel, including production engineers, drilling superintendents, field supervisors and pumpers.

As an explorationist, Mr. Single has been responsible for the development of successful exploration programs and the drilling of over 550 wells with a greater than 55% success ratio. He has been directly involved in the discovery and development of oil and natural gas in fields located in California, Colorado, Illinois, Kansas, Louisiana, Montana, New Mexico, North Dakota, Ohio, Oklahoma, Texas and Wyoming. He has also had natural gas discoveries in Colorado, Ohio, Texas and Wyoming, and been involved in the drilling of some 100 gas wells.

Activity in the Raton Basin:

The Raton Basin continues to be a prolific natural gas production area of major significance with well established coal bed methane plays and what appears to be a tremendous amount of reserves yet to be tapped in the Pierre Shale.

One of Sun River’s competitors, Pioneer Natural Resources reported that in 2008 it drilled 9 wells in the Raton Basin into the Pierre Shale. Two (2) of the wells were drilled horizontally and showed substantial natural gas production.4 There is reason to believe that the Pierre Shale found under Pioneer Natural Resources property extends under Sun River’s properties.

Colorado Interstate Gas Company (CIG), a subsidiary of El Paso, is building the Raton Expansion Project to serve increasing demands for natural gas supplies from the Raton Basin. Known as the Raton Expansion Project, the additional capacity involves the installation of approximately 300 miles of 16 inch pipeline in Las Animas, Huerfano, Pueblo and El Paso counties, Colorado. 5 This additional pipeline capacity should allow for reduced transmission fees charged to gas producers in the region.

Raven Wing Acquisition:

On December 29th, 2009 Sun River Energy announced it had entered into a Definitive Agreement to acquire all of the issued and outstanding shares of Raven Wing Resources, Inc. ("Raven Wing"), a private company, from Skana Capital Corp. (TSXV:SKN) www.skanacorp.com, for $3.5 million in cash and the assumption of $360 thousand in outstanding liabilities. Raven Wing will operate as a wholly owned subsidiary of Sun River Energy, Inc.

With this acquisition, Sun River is gaining intellectual property and associated oil and gas leases in four Project opportunities in the Sweet Grass Arch, Montana; Powder River Basin, Wyoming; and Wasatch Plateau, Utah.

The first project Sun River intends to develop will be in an underdeveloped shallow oil opportunity on the Sweet Grass Arch in Montana.

- Net Acres: ~4,200

- Maximum Well Depth: 2,500 ft. (Vertical)

- Completed Well Cost: $300,000

- Possible Net Wells: 210 (if fully developed on 20 acre spacing)

A second Raven Wing project Sun River can develop in tandem is an intermediate depth oil opportunity in the Powder River Basin, Wyoming.

- Net Acres: ~1,900

- Maximum Well Depth: 8,500 ft. (Vertical)

- Completed Well Cost: $1,000,000

- Possible Net Wells: 24 (if fully developed on 80 acre spacing)

The third Raven Wing opportunity is located on the Wasatch Plateau, Utah, and will target several layered potential gas reservoirs.

- Net Acres: ~36,000

- Maximum Well Depth: 6,000 ft (Vertical)

- Completed Well Cost: $500,000 - $1.5 million (depth and completion dependent)

- Possible Net Wells: up to 300

The fourth Raven Wing opportunity involves only intellectual property to a field infill and extension concept in the Powder River Basin, Wyoming. Raven Wing does not currently hold a land position in this opportunity and Sun River will need to establish one to proceed with this project.

The transaction is subject to Sun River Energy, Inc. arranging acceptable project financing, although no financing has been committed. Sun River management believes this transaction is a significant value acquisition because it provides the positive features of: 1) very low dilution to existing shareholders, 2) ready to drill, low risk, fully evaluated projects in the Rockies, and 3) the potential to develop oil production quickly.

Our Analysis:

Our analysis of the activity within the Raton Basin, including recent drilling activity by Pioneer Natural Resources and the announced pipeline expansion are all positive developments for activity in the Raton Basin. Additionally the acquisition activity involving major natural gas players, including companies such as Exxon Mobil ‘XOM’, XTO Energy ‘XTO’, Total SA ‘TOT’, and Chesapeake Energy ‘CHK’ provides a positive outlook for the company’s valuation.

We are viewing the proposed acquisition of the Raven Wing projects as an extremely positive development for the company. There is the potential to drill an estimated 534 wells in Montana, Wyoming, and Utah. If successful this would help transform Sun River Energy into a major player in the Rocky Mountain Region.

We feel that the shares of Sun River Energy ‘SNRV’ are undervalued at their current levels. Our valuation model suggest a potential value on the company in excess of $6.00 per share. As a result we feel comfortable recommending the accumulation of shares of ‘SNRV’ up to a price level of approximately $5.00 per share.

Footnotes:

1. Peggy Williams. “Growing Prospects, M. Ray Thomasson talks about his exploration and business philosophy and prospect generation in today’s world.” Oil and Gas Investor. March 2008.

2. Sun River Energy. “Sun River Energy Announces Findings From Colfax County New Mexico Interim Report” PR. Newswire. July 9, 2009.

3. “Shell tests gas from New Mexico’s Tucumcari area.” Alexander’s Gas & Oil Connection. Volume 14. Issue # 4. Friday March 20th, 2009.

4. David Bamford. “Pioneer Natural Resources Reports Fourth Quarter 2008 Results.” OilVoice. February 4th, 2009.

5. BJ. Lowe and Lyndsie Mewett. “Pipeline Development in the Land of the Free.” Pipelines International. December, 2009

For additional information on Sun River Energy, please click (here)

Disclaimer: The Sterling Investments series of newsletters is produced by Sterling Investment Services, Inc. (www.sterlinginvestments.com) All information used in the production of this report has been obtained from sources believed to be reliable and accurate. Sterling Investment Services does not warrant or assume any liability for inaccuracy of the information used to produce our publications. To receive further information on these services please visit our web page at: www.sterlinginvestments.com If you would like to contact us our fax # is (678)-530-1017 Email address is: enelson@sterlinginvestments.com Sterling Investment Services may hold positions in the securities recommended or may be providing consulting services to the companies mentioned within this report. Sterling Investment Services, Inc. has not been paid any fee for the production of this report. However in the future, Sterling Investment Services may charge fees for the production of follow up reports or services. Additionally an affiliated company of Sterling Investment Services, Coral Capital Partners, Inc. (www.coralcapital.com) has provided consulting services to Sun River Energy which included business plan development and writing, and financial modeling. Coral Capital Partners was paid a fee for these services which included a combination of cash and warrants which was renegotiated into an all stock position. As a result Coral Capital Partners owns approximately 80,000 shares of Sun River Energy, Inc. which it may elect to sell at any point in time irrespective of the opinions contained within this report. |