Monday June 24th, 2013: A Look at the US 10 Year Bond

A Look at the Market Since Our Last Update: The overall market moved slightly higher on Friday in what can be best described as a slight bounce from the sell off that occurred on Wednesday and Thursday of last week. It should be noted that interest rates continued to move higher last week, as a investors are clearly pulling money out of the bond market. In the commodities markets, Oil was lower by $1.49 to $95.18 per barrel, and Gold was higher by $5.80 to $1,292.00 per ounce. In the grain markets, Wheat was lower by $0.024 to $6.980 per bushel, while Corn was lower by $0.114 to $6.6616 per bushel, and Soybeans were lower by $0.042 to $14.932 per bushel.

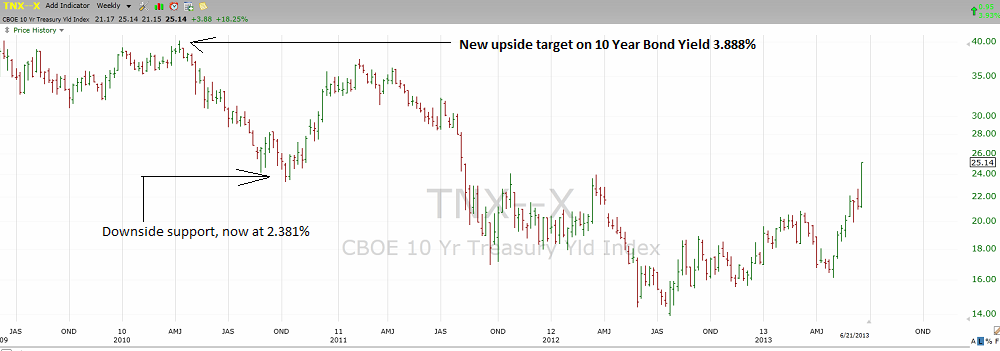

A Few Thoughts on the Upcoming Market: As I stated in Friday’s edition of the Sterling Market Commentary, I am expecting the overall market to continue to move lower; and nothing that occurred on Friday has changed my expectations. I thought today would be a good day to take a look at interest rates. I have inserted a chart of the US 10 Year Bond below for your review.

As you can see the Yield of the US Government 10 Year Bond is clearly headed higher.? The question is how much higher will the yield of the 10 Year Bond go? And conversely, how much lower will the price of the 10 Year Bond drop? I think that due to the nature of the recent move higher a look at a longer term chart is required. I took a look at the weekly chart of the US 10 Year Bond Yield and have inserted one below for your review.

It looks like the US 10 Year Bond Yield broke above upside resistance at 2.381%, which has now become downside support, with new upside resistance now at 3.888% on a longer term basis.? What I see is interest rates continuing to move higher and test 3.888% on a closing basis. It is important to know that as interest rates rise, the value of bonds, and dividend paying stocks will decline. In the March 5th, 2012 edition of the Sterling Weekly I took a look at how the price of Bonds could decline with rising interest rates. The following is a link to that article: https://sterlinginvestments.com/sterling-weekly-for-the-week-of-march-5th-2012-a-look-at-bond-prices-and-higher-rates/

Dow Jones Industrial Average: The Dow Jones Industrial Average closed yesterday at 14,799.40. I see upside resistance on the Dow Jones Industrial Average at 14,865.14 and downside support at 14,421.49 and then at 14,035.67? Current Expectations: I see the Dow Jones Industrial Average continuing to move lower and testing 14,421.49 on a closing basis.

Follow us on Twitter under sterlinginv and get our intra-day comments on the market.

To see all of our Market Commentary blog postings, please visit: https://sterlinginvestments.com/category/market-commentary/