Sterling Market Commentary for Thursday November 29th, 2012

A Look at Wednesday’s Market: The overall market finished Wednesday solidly higher after rallying sharply from an early morning sell off that saw the Dow Jones Industrial Average down almost 100 points. The rally was sparked by comments from politicians in Washington D.C. who were commenting on the prospects for resolving the fiscal cliff. However, it is extremely important to remember that these comments are basically “talking points” and that until an agreement or deal is actually reached and signed off on, things are subject to change at any point in time. Nothing should be taken for granted at this point in time, and the politicians in Washington deserve every bit of skepticism we can give them and then some. I continue to caution my readers against being suckered into a rally fueled by comments from politicians speaking in front of the press. It is equally important to remember that the “devil is in the details” and until we see the actual details of a deal we should not assume that any agreement will automatically make the economy better. Additionally we should never forget that there are a huge number of regulations and taxes slated to start taking effect in 2013 as part of Obamacare and Dodd-Frank. These new taxes and regulations will almost certainly have a chilling effect on the U.S. economy.

A Few Thoughts on Thursday’s Market: I am basically expecting the overall market to track sideways with a downward bias over the course of the next several trading sessions. We might see a few up days, but really at the end of the day what we are witnessing is the continued ability of a skilled Democratic party that is more than adept at manipulating an uneducated into supporting their goals of ever rising taxes and spending that is battling a Republican party that still after nearly 3 decades has not learned how to effectively frame a debate or discussion.

We should never forget the following:

- That it is pro-growth economic policies that create a growing and healthy economy. Pro-growth economic policies include reasonable and sustainable levels of government spending, a competitive tax policy environment, and a level of government regulation that does not place an undue burden on businesses or the economy.

- That economic austerity is high taxes combined with spending cuts in spending.

- That Keynesian spending, also known as high deficit spending, is not stimulus or stimulating. It actually has a negative, or depressing effect on an economy. I should actually be referred to as an “anti-growth” policy, as it definitely is not a pro-growth policy.

The U.S. Economy has now experienced four (4) years of the largest Keynesian experiment in its history with very dismal results. We are currently going through one of the greatest periods of re-regulation in my lifetime; and we are now talking about implementing some form of economic austerity in order to deal with out of control, runaway government spending. All of this is a recipe for an economic downturn. What this country needs is massive regulatory, tax, and entitlement reform, coupled with a reduction in spending that brings the total level of Federal Spending (including interest on the Federal Debt) down below 19% of Gross Domestic Product.

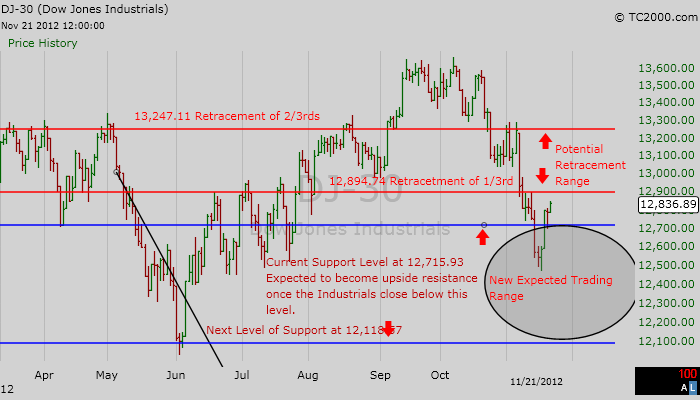

The Dow Jones Industrial Average: The Dow Jones Industrial Average closed at 12,985.11 I see upside resistance on the Dow Jones Industrial Average at 13,115.54 on a closing basis. I now see downside support coming in at 12,715.93 on a closing basis. Current Expectations: I think we are starting a new trend lower in the Dow. I am expecting the Dow Jones Industrial Average to continue to move lower and test 12,715.93 on a closing basis.

Dow Jones Transportation Average: The Dow Jones Transportation Average closed at 5,114.86 I continue to see upside resistance on the the Dow Transportation Average at 5,215.97 and downside support at 4,873.76 and then at 4,795.28. Current Expectations: I think the Dow Transports are going to track sideways between support and resistance for the foreseeable future.

S&P 500 ‘SPX’: The S&P 500 closed yesterday at 1,409.93 I currently see upside resistance on the S&P 500 at 1,419.04 and downside support on the S&P 500 at 1,359.88 and then at 1,343.36 Current Expectations: I think the S&P 500 is going to move lower and test 1,359.88 and then 1,343.36 on a closing basis.

NASDAQ 100 Index ‘NDX’: The NDX closed yesterday at 2,665.27 I see upside resistance on the NDX currently at 2,655.81 and downside support at 2,524.36 on a closing basis. Current Expectations: I think the NDX is going to continue to move lower and test 2,524.36 and then 2,458.83 on a closing basis.

The Bottom Line: I think the market will continue to move lower for the next few trading sessions.